Xcel Energy 2006 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2006 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.40

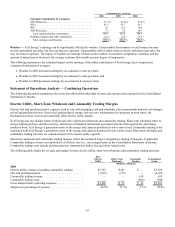

Item 7 — Management’s Discussion and Analysis of Financial Condition and Results of Operations

Business Segments and Organizational Overview

Continuing Operations

Xcel Energy is a public utility holding company. In 2006, Xcel Energy continuing operations included the activity of four utility

subsidiaries that serve electric and natural gas customers in 8 states. These utility subsidiaries are NSP-Minnesota; NSP-Wisconsin;

PSCo; and SPS. These utilities serve customers in portions of Colorado, Michigan, Minnesota, New Mexico, North Dakota, South

Dakota, Texas and Wisconsin. Along with WGI, an interstate natural gas pipeline, these companies comprise the continuing regulated

utility operations.

Xcel Energy’s nonregulated subsidiary reported in continuing operations is Eloigne, which invests in rental housing projects that

qualify for low-income housing tax reported credits.

Discontinued Operations

See Note 2 to the Consolidated Financial Statements for discussion of discontinued operations.

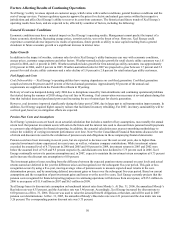

Forward-Looking Statements

Except for the historical statements contained in this report, the matters discussed in the following discussion and analysis are

forward-looking statements that are subject to certain risks, uncertainties and assumptions. Such forward-looking statements are

intended to be identified in this document by the words “anticipate,” “believe,” “estimate,” “expect,” “intend,” “may,” “objective,”

“outlook,” “plan,” “project,” “possible,” “potential,” “should” and similar expressions. Actual results may vary materially. Factors that

could cause actual results to differ materially include, but are not limited to: general economic conditions, including the availability of

credit and its impact on capital expenditures and the ability of Xcel Energy and its subsidiaries to obtain financing on favorable terms;

business conditions in the energy industry; actions of credit rating agencies; competitive factors, including the extent and timing of the

entry of additional competition in the markets served by Xcel Energy and its subsidiaries; unusual weather; effects of geopolitical

events, including war and acts of terrorism; state, federal and foreign legislative and regulatory initiatives that affect cost and

investment recovery, have an impact on rates or have an impact on asset operation or ownership; structures that affect the speed and

degree to which competition enters the electric and natural gas markets; costs and other effects of legal and administrative

proceedings, settlements, investigations and claims; actions of accounting regulatory bodies; the items described under Factors

Affecting Results of Continuing Operations; and the other risk factors listed from time to time by Xcel Energy in reports filed with the

SEC, including “Risk Factors” in Item 1A of Xcel Energy’s Form 10-K for the year ended Dec. 31, 2006 and Exhibit 99.01 to Xcel

Energy’s Form 10-K for the year ended Dec. 31, 2006.

Management’s Strategic Plan

Xcel Energy’s strategy, called Building the Core, is to invest in the core utility businesses and earn a reasonable return on invested

capital. We’re a vertically integrated utility and intend to stay that way. Investments of approximately $9 billion are planned over the

next five years in our core operations to grow our business in response to growing customer demand and environmental initiatives.

The need for additional energy supply is expected throughout our service territory. Many of the states in which we operate are

considering renewable portfolio standards, requiring incremental investment in wind generation and transmission facitlities.

Additionally, we continue to focus on enhancing electric system reliability including making significant investments in transmission

and distribution systems. These customer driven requirements create investment opportunities for us.

The strategy of Building the Core has three phases. The first phase is obtaining legislative and regulatory support for large investment

initiatives prior to making the investment. To avoid excessive risk for the company, it is critical to reduce regulatory uncertainty

before making large capital investments. We accomplished this for both the MERP in Minnesota and the Comanche 3 coal plant in

Colorado. Transmission legislation has been passed in Minnesota, allowing that state’s regulatory commission to approve recovery for

transmission investments without filing a general rate case. In Texas, the legislature authorized annual recovery for transmission

infrastructure improvements. Both legislative initiatives support necessary new investment in our transmission system.

The second phase is making those investments. In a normal year, we spend approximately $1 billion on capital projects. In addition to

a base level of capital investment, we expect to have significant investment opportunity. Among those opportunities are:

• approximately $1 billion through 2010 for MERP, a project to convert two aging coal-fired plants to natural gas plants and to

install pollution control equipment at a third coal plant;

• approximately $1 billion through 2010 for Comanche 3, a project to build a coal plant in Colorado;