Western Union 2013 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2013 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

73 | The Western Union Company – Proxy Statement

Proposal 2 PROXY STATEMENT

NOTICE OF 2014 ANNUAL MEETING OF STOCKHOLDERS AND PROXY STATEMENT

• What We Don’t Do:

No change-in-control tax gross ups.

No repricing or buyout of underwater stock options.

Prohibition against employee and director pledging and

hedging of Company securities.

No dividends or dividend equivalents accrued or paid

on performance-based restricted stock unit awards or

time-based restricted stock unit awards.

Recent Compensation Actions

In late 2012, the Company began implementing pricing

and other strategic investments designed to position the

Company for future growth. In evaluating the 2013 design

of the Company’s executive compensation program,

the Compensation Committee considered that many of

the strategic investments implemented by the Company

beginning in late 2012 were expected to have a negative

impact on 2013 financial performance. Accordingly, for

2013, many of the compensation decisions were designed

to further align the program with the Company’s mid-

and long term operating plans, increase participant

accountability, and drive motivation and retention beyond

2013. These decisions included:

• No Executive Base Salary Increases for 2013 or

2014: There was no change in our named executive

officers’ base salary levels for 2013 or 2014 from levels

effective March 2012.

• No 2012 Chief Executive Officer Bonus: Based

on 2012 Company performance, our Chief Executive

Officer did not receive a bonus in 2013.

• 2013 Annual Incentive Includes Restricted Stock

Unit Component: In 2013, we modified the Company’s

Annual Incentive Plan design to include individual

and/or business unit performance objectives, and a

restricted stock unit award to be granted based on the

achievement of strategic objectives and a threshold

operating income goal to further focus participants on

the long-term performance of the Company.

• 2013 Long Term Incentive Includes TSR Modifier:

We modified the Long-Term Incentive Plan design to

include 2013 and 2014 financial performance metrics,

while still maintaining a longer-term perspective in the

program with a TSR payout modifier.

• Realizable Compensation Lower than Reported

Compensation: Our named executive officers’

realizable compensation has been lower than the

compensation disclosed in our Summary Compensation

Table for fiscal years 2011 to 2013. See the “2013

Realizable Compensation Table” on page 42.

These practices, in combination with a competitive market

review, limited executive perquisites, and reasonable

severance pay multiples contribute to an executive

compensation program that is competitive yet strongly

aligned with stockholder interests.

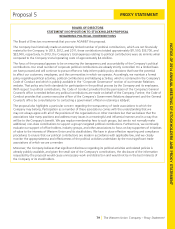

The Board recommends that you vote in favor of the

following “say-on-pay” resolution:

RESOLVED, that the stockholders of the Company

approve, on an advisory basis, the compensation

of the Company’s named executive officers, as

disclosed pursuant to Item 402 of Regulation S-K in

the Compensation Discussion and Analysis section,

the tabular disclosure regarding such compensation,

and the accompanying narrative disclosure, each as

set forth in the Company’s Proxy Statement for its

2014 Annual Meeting of Stockholders.

Required Vote

The affirmative vote of the holders of a majority of shares

of the Company’s Common Stock present in person

or represented by proxy at the meeting and entitled to

vote on the subject matter is required to approve this

Proposal 2.

Because your vote is advisory, it will not be binding upon

the Board of Directors. However, the Compensation

Committee may take into account the outcome

of the vote when considering future executive

compensation arrangements.

THE BOARD OF DIRECTORS RECOMMENDS

THAT YOU VOTE FOR PROPOSAL 2.