Western Union 2013 Annual Report Download - page 169

Download and view the complete annual report

Please find page 169 of the 2013 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2013 FORM 10-K

59

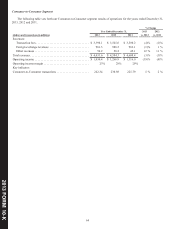

Revenues overview

Transaction volume is the primary generator of revenue in our businesses. Transaction fees are fees that consumers pay when

they send money or make payments. Consumer-to-Consumer transaction fees generally vary according to the principal amount of

the money transfer and the locations from and to which the funds are sent and received. Additionally, in certain consumer money

transfer and Business Solutions transactions involving different send and receive currencies, we generate foreign exchange revenues

based on the difference between the exchange rate set by us to the consumer or business and the rate at which we or our agents

are able to acquire the currency. In our Consumer-to-Consumer business, foreign exchange revenue is primarily driven by

international Consumer-to-Consumer cross-currency transactions. The majority of transaction fees and foreign exchange revenues

were contributed by our Consumer-to-Consumer segment for all periods presented, which is discussed in greater detail in "Segment

Discussion."

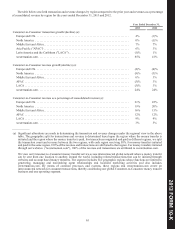

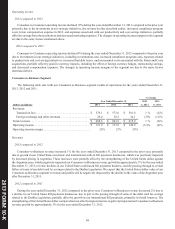

2013 compared to 2012

Consolidated revenue decreased 2% during the year ended December 31, 2013 compared to 2012. This decrease was caused

by our Consumer-to-Consumer segment, primarily due to price reductions in key corridors and the impact of compliance related

actions in various corridors (see "Enhanced Regulatory Compliance" described below), partially offset by Consumer-to-Consumer

transaction growth. The strengthening of the United States dollar compared to most other foreign currencies negatively impacted

revenue growth by approximately 1% in the year ended December 31, 2013.

Foreign exchange revenues increased for the year ended December 31, 2013 compared to 2012 primarily due to growth in

our Business Solutions segment and increased amounts of cross-border principal sent in our Consumer-to-Consumer segment,

partially offset by price reductions in certain corridors in our Consumer-to-Consumer segment.

Fluctuations in the exchange rate between the United States dollar and other currencies have resulted in a reduction to transaction

fees and foreign exchange revenues for the year ended December 31, 2013 of $70.3 million over the previous year, net of foreign

currency hedges, that would not have occurred had there been constant currency rates.

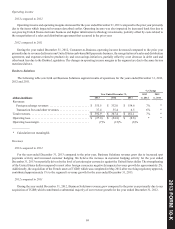

2012 compared to 2011

Consolidated revenue increased 3% during the year ended December 31, 2012 due to the acquisition of TGBP, which

contributed approximately 4% to consolidated revenue growth for the period, and Consumer-to-Consumer transaction growth of

2%, partially offset by the strengthening of the United States dollar compared to most other foreign currencies and slight price

reductions. The strengthening of the United States dollar compared to most other foreign currencies negatively impacted revenue

growth by approximately 2% in the year ended December 31, 2012.

Foreign exchange revenues increased for the year ended December 31, 2012 compared to 2011 primarily due to the acquisition

of TGBP.

Fluctuations in the exchange rate between the United States dollar and other currencies resulted in a reduction to transaction

fees and foreign exchange revenues for the year ended December 31, 2012 of $93.8 million over the previous year, net of foreign

currency hedges, that would not have occurred had there been constant currency rates.