Western Union 2013 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2013 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Compensation Discussion and Analysis PROXY STATEMENT

The Western Union Company – Proxy Statement | 48

NOTICE OF 2014 ANNUAL MEETING OF STOCKHOLDERS AND PROXY STATEMENT

• Increasecross-functionalexecutivefocusinthe

coming years on key performance metrics through

performance-based restricted stock unit awards; and

• Retaintheservicesofexecutivesthroughmulti-year

vesting provisions.

The 2013 performance-based restricted stock unit awards

will vest if and only to the extent that specific performance

goals for revenues and operating income are met during

the performance period. The 2013 grid provides for

a payout of 95% of target if the Company achieves

its internal operating plan for revenues and operating

income during the performance period. Because in 2013

the Company was implementing key strategic actions,

the Compensation Committee approved 2013 and 2014

financial performance metrics, while still maintaining a

longer-term perspective in the program with a TSR payout

modifier. Given the difficulty at the time of forecasting

multi-year financial results, the Compensation Committee

believed that it was appropriate to use shorter-term

financial objectives as key indicators of the Company’s

execution of its 2013 strategic plan.

Under the terms of the performance-based restricted

stock unit awards, as much as 150% of the targeted

performance-based restricted stock unit awards may

be earned based on the Company’s performance with

respect to the two performance objectives described

above, with 50% of the award determined based on 2013

performance and the other 50% based on 2014 growth

as compared to 2013. Further, the 2013 performance-

based restricted stock unit awards include a relative TSR

performance measure that may increase or decrease

the payout of the award by up to 33% based on the

Company’s TSR performance relative to the TSR of the

S&P 500 Index over the 2013-2015 performance period.

No adjustment will be made to the award payout level if

the Company’s TSR performance is between the 40th and

60th percentile of the TSR performance of the S&P 500

Index over the 2013-2015 performance period. The 2013

performance-based restricted stock unit awards include a

maximum payout of 200% of the targeted awards based

on achieving maximum revenue and operating income

performance objectives and relative TSR performance in

the top quartile of the S&P 500 Index, as compared to the

maximum payout of 300% of the targeted performance-

based restricted stock unit awards used in prior years.

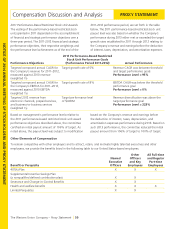

The performance objectives for payment of the 2013

performance-based restricted stock unit awards and their

respective weightings were:

• 2013revenueandoperatingincome (each weighted

50%), measured against the Company’s 2013 strategic

operating plan (weighting 50%); and

• Targetedannualconstantcurrencygrowthratefor

revenue and operating income (each weighted 50%),

comparing 2014 actual performance against 2013

actual performance (weighting 50%).

Given the focus in 2013 on revenue and operating

income performance, the committee determined that it

was appropriate to use revenue and operating income

metrics in the design of both the Annual Incentive Plan

and Long-Term Incentive Plan. Accordingly, 2013 revenue

and operating income performance was measured using

the same grid that was used for purposes of the Annual

Incentive Plan, but with an extension of the grid to a

150% payout level (based on achieving revenue and

operating income equal to or greater than approximately

$5.9 billion and $1.2 billion, respectively) rather than

the maximum cash payout level of 125% under the

Annual Incentive Plan. Please see page 45 for the 2013

revenue and operating income payout grid. Under the

Annual Incentive Plan, the committee supplemented

these performance metrics with the addition of strategic

and individual/business unit performance objectives,

while in the Long-Term Incentive Plan the metrics were

supplemented with a TSR modifier. The committee viewed

these additional performance metrics as complementary

to the revenue and operating income objectives as well

as the Company’s strategic operating plan. For 2014, the

performance-based restricted stock units will vest based

on the growth rate for revenue and operating income as

compared to 2013.

Similar to the Annual Incentive Plan, when the financial

performance objectives were established, the committee

determined that the effect of currency fluctuations on