Western Union 2013 Annual Report Download - page 260

Download and view the complete annual report

Please find page 260 of the 2013 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2013 FORM 10-K

150

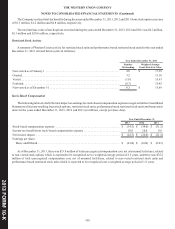

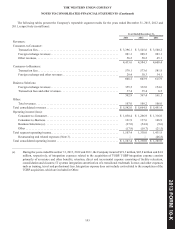

CONDENSED FINANCIAL INFORMATION OF THE REGISTRANT

THE WESTERN UNION COMPANY

NOTES TO CONDENSED FINANCIAL STATEMENTS

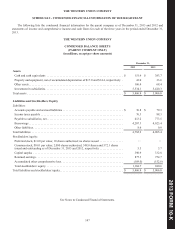

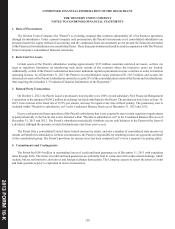

1. Basis of Presentation

The Western Union Company (the "Parent") is a holding company that conducts substantially all of its business operations

through its subsidiaries. Under a parent company only presentation, the Parent's investments in its consolidated subsidiaries are

presented under the equity method of accounting, and the condensed financial statements do not present the financial statements

of the Parent and its subsidiaries on a consolidated basis. These financial statements should be read in conjunction with The Western

Union Company's consolidated financial statements.

2. Restricted Net Assets

Certain assets of the Parent's subsidiaries totaling approximately $335 million constitute restricted net assets, as there are

legal or regulatory limitations on transferring such assets outside of the countries where the respective assets are located.

Additionally, certain of the Parent's subsidiaries must meet minimum capital requirements in some countries in order to maintain

operating licenses. As of December 31, 2013, the Parent is in a stockholders' equity position of $1,104.7 million, and as such, the

restricted net assets of the Parent's subsidiaries currently exceeds 25% of the consolidated net assets of the Parent and its subsidiaries,

thus requiring this Schedule I, "Condensed Financial Information of the Registrant."

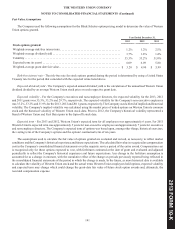

3. Related Party Transactions

On October 1, 2012, the Parent issued a promissory note payable to its 100% owned subsidiary First Financial Management

Corporation in the amount of $268.2 million in exchange for funds distributed to the Parent. The promissory note is due on June 30,

2015, bears interest at the fixed rate of 0.23% per annum, and may be repaid at any time without penalty. The promissory note is

included within "Payable to subsidiaries, net" in the Condensed Balance Sheets as of December 31, 2013 and 2012.

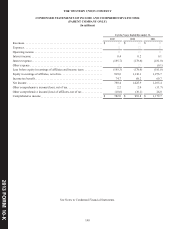

Excess cash generated from operations of the Parent's subsidiaries that is not required to meet certain regulatory requirements

is paid periodically to the Parent and is also included within "Payable to subsidiaries, net" in the Condensed Balance Sheets as of

December 31, 2013 and 2012. The Parent's subsidiaries periodically distribute excess cash balances to the Parent in the form of

a dividend, although the amounts of such dividends may vary from year to year.

The Parent files a consolidated United States federal income tax return, and also a number of consolidated state income tax

returns on behalf of its subsidiaries. In these circumstances, the Parent is responsible for remitting income tax payments on behalf

of the consolidated group. The Parent's provision for income taxes has been computed as if it were a separate tax-paying entity.

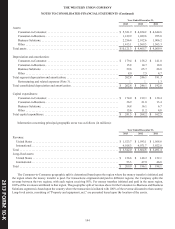

4. Commitments and Contingencies

The Parent had $14.4 million in outstanding letters of credit and bank guarantees as of December 31, 2013 with expiration

dates through 2014. The letters of credit and bank guarantees are primarily held in connection with credit-related dealings, which

include, but are not limited to, derivatives and foreign exchange transactions. The Company expects to renew the letters of credit

and bank guarantees prior to expiration in most circumstances.