Western Union 2013 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2013 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

55 | The Western Union Company – Proxy Statement

NOTICE OF 2014 ANNUAL MEETING OF STOCKHOLDERS AND PROXY STATEMENT

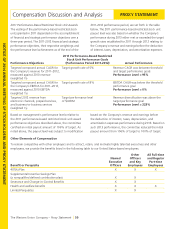

Compensation Discussion and Analysis PROXY STATEMENT

•Annual Incentive Plan Target and Payout Level. No

changes were made to Mr. Agrawal’s annual incentive

target of $405,000. Under the terms of the Annual

Incentive Plan design, Mr. Agrawal had an opportunity

to receive up to $506,250 in cash and up to $303,750

in restricted stock units. The maximum Annual Incentive

Plan award that Mr. Agrawal could have earned during

2013 (consisting of both the cash and restricted stock

unit award components) was 200% of Mr. Agrawal’s

target, or $810,000. As a business unit leader in 2013,

the Compensation Committee determined that it was

appropriate that Mr. Agrawal’s cash opportunity under

the Annual Incentive Plan be based 50% on corporate

performance and 50% on the performance of

Western Union Business Solutions as well as individual

performance. Mr. Agrawal’s 2013 Annual Incentive

Plan award payout consisted of (i) a $324,000 cash

award reflecting a blended payout of 80% of target

based on the Company’s achievement of the corporate

performance goals and Mr. Agrawal’s achievement of

his individual/business unit performance goals, and

(ii) a $68,900 restricted stock unit award reflecting

a payout of 17% of target based on the Company’s

achievement of its strategic performance goals (versus a

payout of 25% of target that would have been paid had

the Company achieved its internal plan for its strategic

performance goals).

•Long-Term Incentive Award. For 2013, no changes

were made to Mr. Agrawal’s long-term incentive award

target. Accordingly, Mr. Agrawal’s 2013 long-term

incentive award target remained at $1,300,000.

J. David Thompson

Executive Vice President, Global Operations

(November 2012 to present) and Chief Information

Officer (April 2012 to present)

In February 2013, the Compensation Committee set

Mr. Thompson’s 2013 compensation levels, including

his annual and long-term incentive award targets, as

discussed below. In determining Mr. Thompson’s 2013

target compensation levels, the committee considered

Mr. Thompson’s 2012 performance, his increased

responsibilities as head of global operations, the market

data as well as the Company’s strategic objectives of

further enhancing the Company’s information technology

capabilities. Accordingly, the committee assigned a

significant value to Mr. Thompson’s position and less value

to its review of the market data. The committee increased

Mr. Thompson’s long-term incentive target to reflect his

increased responsibilities since joining the Company and

to bring his total compensation into closer alignment with

market levels.

• Base Salary. For 2013, no changes were made to

Mr. Thompson’s annual base salary. Accordingly, Mr.

Thompson’s annual base salary remained at $500,000.

•Annual Incentive Plan Target and Payout Level. For 2013,

no changes were made to Mr. Thompson’s Annual

Incentive Plan target of $450,000. Under the terms of

the Annual Incentive Plan design, Mr. Thompson had

an opportunity to receive up to $562,500 in cash and

up to $337,500 in restricted stock units. The maximum

Annual Incentive Plan award that Mr. Thompson could

have earned during 2013 (consisting of both the cash

and restricted stock unit award components) was

200% of Mr. Thompson’s target, or $900,000. As an

executive officer holding a corporate-wide position,

the Compensation Committee determined that it was

appropriate that Mr. Thompson’s cash opportunity

under the Annual Incentive Plan be based 75%

on corporate performance and 25% on individual

performance. Mr. Thompson’s 2013 Annual Incentive

Plan award payout consisted of (i) a $360,000 cash

award reflecting a blended payout of 80% of target

based on the Company’s achievement of the corporate

performance goals and Mr. Thompson’s achievement

of his individual/business unit performance goals, and

(ii) a $76,500 restricted stock unit award reflecting

a payout of 17% of target based on the Company’s

achievement of its strategic performance goals (versus a

payout of 25% of target that would have been paid had

the Company achieved its internal plan for its strategic

performance goals).

• Discretionary Awards. In early 2014, the committee

also awarded Mr. Thompson a discretionary restricted

stock unit award with a grant value of $240,000 in

recognition of his performance during 2013 and for

retention purposes. The restricted stock unit award is

scheduled to vest in four annual installments, subject to

Mr. Thompson’s continued employment through each

vesting date.

•Long-Term Incentive Award. For 2013, the committee

increased Mr. Thompson’s long-term incentive award

target to $1,200,000 from $1,000,000.