Western Union 2013 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2013 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

We also continued to expand our options for sending or

receiving money, with more transactional websites,

mobile money transfer services, and capabilities to

move money directly to or from a bank account in cer-

tain countries.

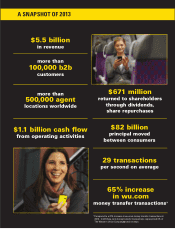

At the end of 2013, we offered our services at more

than 100,000 ATMs across the world. We now have 19

active mobile money transfer connections in 17 coun-

tries, wu.com transactional sites in more than 20 coun-

tries, and customers can use our mobile app in the U.S.

and Australia to send money around the globe. In addi-

tion, we have agreements with more than 75 banks to

offer our account-based money transfer service.

We continued to add strategic new agent relationships

last year, including Banorte in Mexico, Alexandria Bank

in Egypt, Riyad Bank in Saudi Arabia, and Walgreens

in the U.S. We also renewed and expanded our agree-

ment with La Banque Postale in Europe, one of our

largest agents.

Consumer-to-consumer transactions increased 5% for

the year, with 9% growth in the fourth quarter. Revenue

declined 3%, as expected, primarily due to the pricing

actions we began in late 2012. Electronic channels deliv-

ered strong growth, with revenue increasing 25% for the

year, representing 5% of our overall revenue in 2013.

Increasing customers and usage in

business-to-business

We’re also listening to small- and medium-sized enterprises

(SMEs), which have different—but equally important—

needs than consumers.

Last year, we introduced a variety of new products and

services, including a new cash management dashboard

tool for SMEs, new services for non-governmental

organizations and options and forwards products in addi-

tional markets.

We significantly expanded our services in India and

Japan, and we increased offerings for cross-border

tuition payments in several countries, including China,

India and South Korea.

These services contributed to a 7% revenue increase in

our Business Solutions segment last year, and allowed

us to meet some of the real and growing needs of

our customers to better manage their cash flows and

foreign-currency exposures.

Business Solutions now offers cross-border payments

in 32 countries and represented 7% of our overall reve-

nue in 2013.

Generating and deploying strong cash flow for

shareholders

One of the great qualities of our business model is our

ability to generate strong cash flow. Although 2013

was an investment year, with pricing, compliance and

other strategic investments, the company once again

generated more than $1 billion of cash flow from oper-

ating activities.

In 2013, Western Union returned $671 million to share-

holders through share repurchases and dividends.

Our commitment to customers and society

We are listening to our customers in other ways, too.

We continue to implement compliance and fraud-

prevention enhancements around the world to pro-

tect our customers and their hard-earned money. We

believe this commitment will make us stronger over the

long term.

We also are committed to giving back to the communi-

ties where our services are offered. In 2013, the Western

Union Foundation gave approximately $8 million to

causes supporting education and disaster-relief efforts

around the world.

The future

We remain focused on executing our strategic priorities to

return our business to stronger revenue and profit growth.

We will continue to be proactive—anticipating, adapting

to and addressing the ever-changing needs of our cus-

tomers, always striving to stay one step ahead.

In 2014, this means continuing to strengthen our con-

sumer money transfer business, with an emphasis on

digital expansion, to drive strong growth in Business

Solutions, and to generate and deploy strong cash flow

for our shareholders.

We have a clear vision and a solid foundation for growth.

We have millions of loyal customers. And, we have

passionate, hard-working colleagues around the globe.

We are focused on executing our vision and creating

long-term value for our shareholders.

Thank you for your commitment to Western Union and,

most importantly, to our customers!

HIKMET ERSEK

President, Chief Executive Officer and Director

April 2, 2014