Western Union 2013 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2013 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

67 | The Western Union Company – Proxy Statement

NOTICE OF 2014 ANNUAL MEETING OF STOCKHOLDERS AND PROXY STATEMENT

Executive Compensation PROXY STATEMENT

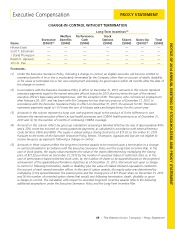

• AnunapprovedchangeinamajorityoftheBoard

members; and

• Certaincorporaterestructurings,includingcertain

mergers, dissolution and liquidation.

The Executive Severance Policy provided for the

following severance and change-in-control benefits as of

December 31, 2013, and continues to provide for those

benefits, except as noted below:

• Effective for senior executives hired before February

24, 2011, a severance payment equal to the senior

executive’s base pay plus target bonus for the year in

which the termination occurs (the “base severance

pay”), multiplied by two. Effective for senior executives

hired on and after February 24, 2011, a senior executive

employed by the Company for 12 months or less was

entitled to receive a severance payment equal to the

base severance pay and, for every month employed in

excess of 12 months, an additional severance payment

equal to a pro rata portion of the base severance pay,

up to a maximum severance payment equal to the

senior executive’s base severance pay, multiplied by two.

On February 20, 2014, the Compensation Committee

amended the Executive Severance Policy to provide for

a severance payment equal to the senior executive’s

base severance pay multiplied by 1.5 (multiplied by

two in the case of the Chief Executive Officer and in

the case of all senior executives who terminate for an

eligible reason within twenty-four months following a

change-in-control). The provisions limiting severance

payments to newly hired senior executives continue

to apply, subject to the new severance payment cap

described above.

• Acashpaymentequaltothelesserofthesenior

executive’s prorated target bonus under the Annual

Incentive Plan for the year in which the termination

occurs or the maximum bonus which could have been

paid to the senior executive under the Annual Incentive

Plan for the year in which the termination occurs, based

on actual Company performance during such year.

No bonus will be payable unless the Compensation

Committee certifies that the performance goals under

the Annual Incentive Plan have been achieved for the

year in which the termination occurs (except for eligible

terminations following a change-in-control).

• Providedthattheseniorexecutiveproperlyelects

continued health care coverage under applicable law,

a lump sum payment equal to the difference between

active employee premiums and continuation coverage

premiums for eighteen months of coverage.

• AtthediscretionoftheCompensationCommittee,

outplacement benefits may be provided to the executive.

• AllawardsmadepursuanttoourLong-TermIncentive

Plan, including those that are performance-based,

generally will become fully vested and exercisable if

a senior executive is involuntarily terminated without

cause, or terminates for good reason, within twenty-

four months following a change-in-control. In such

event, the right to exercise stock options will continue

for twenty-four months (thirty-six months in the case of

the Chief Executive Officer) after the senior executive’s

termination (but not beyond their original terms).

• Ifaseniorexecutiveisinvoluntarilyterminatedwithout

cause and no change-in-control has occurred, awards

granted pursuant to our Long-Term Incentive Plan (other

than most “career share” grants) generally will vest on

a prorated basis based on the period from the grant

date to the termination date and stock options will

remain exercisable until the end of severance period

under the Executive Severance Policy, but not beyond

the stock options’ original terms. “Career shares” are

time-based restricted share units that become 100%

vested on the fourth anniversary of their grant date

that were previously granted to certain executives as

additional retention awards. Generally, “career shares”

are forfeited upon a termination for any reason.

• Withrespecttoexecutivesnoteligibletoreceivetax

gross-ups, benefits triggered by a change-in-control

are subject to an automatic reduction to avoid the

imposition of excise taxes under Section 4999 of the

Internal Revenue Code in the event such reduction

would result in a better after-tax result for the executive.

• Forindividualswhowereseniorexecutivesonorbefore

April 30, 2009, if benefits payable after a change-

in-control exceed 110% of the maximum amount of

such benefits that would not be subject to the excise

tax imposed by Section 4999 of the Internal Revenue

Code, an additional cash payment in an amount that,

after payment of all taxes on such benefits (and on such

amount), provides the senior executive with the amount

necessary to pay such tax. (If the benefits so payable do

not exceed such 110% threshold, the amount thereof

will be reduced to the maximum amount not subject to

such excise tax.)