Western Union 2013 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2013 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

53 | The Western Union Company – Proxy Statement

NOTICE OF 2014 ANNUAL MEETING OF STOCKHOLDERS AND PROXY STATEMENT

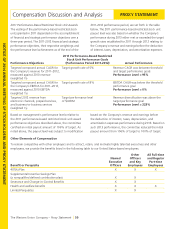

Compensation Discussion and Analysis PROXY STATEMENT

Clawback Policy

The Board of Directors adopted a clawback policy in

2009. Under the policy, the Company may, in the Board’s

discretion and subject to applicable law, recover incentive

compensation paid to an executive officer of the Company

(defined as an individual subject to Section 16 of the

Exchange Act, at the time the incentive compensation

was received by or paid to the officer) if the compensation

resulted from any financial result or performance metric

impacted by the executive officer’s misconduct or fraud.

The Board is monitoring this policy to ensure that it is

consistent with applicable laws, including any requirements

under the Dodd-Frank Wall Street Reform and Consumer

Protection Act (the “Dodd-Frank Act“).

Tax Implications of Executive Compensation Program

Under Section 162(m) of the Internal Revenue Code,

named executive officer (other than the Chief Financial

Officer) compensation over $1 million for any year is

generally not deductible for United States income tax

purposes. Performance-based compensation is exempt

from the deduction limit, however, if certain requirements

are met. The Compensation Committee structures

compensation to take advantage of this exemption under

Section 162(m) to the extent practicable, while satisfying

the Company’s compensation policies and objectives.

Because the Compensation Committee also recognizes the

need to retain flexibility to make compensation decisions

that may not meet the standards of Section 162(m) when

necessary to enable the Company to continue to attract,

retain, and motivate highly-qualified executives, it reserves

the authority to approve potentially non-deductible

compensation in appropriate circumstances.

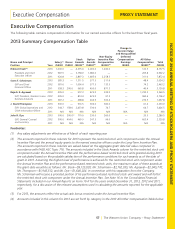

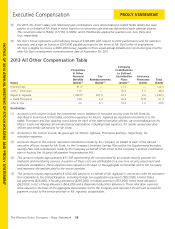

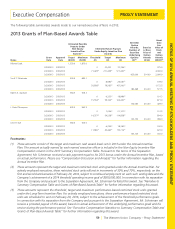

Compensation of Our Named Executive Officers

This section describes the compensation paid to or

earned by our named executive officers during 2013.

In establishing the 2013 compensation levels for our

named executive officers, the committee relied on

the philosophy, objectives, and procedures set forth

above under “-Establishing and Evaluating Executive

Compensation,” including the committee’s review

of market data and consideration of the input of the

Compensation Consultant.

Hikmet Ersek

President and Chief Executive Officer

Mr. Ersek’s 2013 compensation was weighted significantly

toward variable and performance-based incentive pay

over fixed pay, and long-term, equity-based pay over

annual cash compensation, because the Compensation

Committee desired to tie a significant level of Mr. Ersek’s

compensation to the performance of the Company.

The percentage of compensation delivered in the form

of performance-based compensation is higher for

Mr. Ersek than compared to the other named executive

officers because the Compensation Committee believes

that the Chief Executive Officer’s leadership is one of

the key drivers of the Company’s success, and that a

greater percentage of the Chief Executive Officer’s total

compensation should be variable as a reflection of the

Company’s level of performance. Market data provided

by the Compensation Consultant supported this practice

as well. Accordingly, at target-level performance for 2013,

Mr. Ersek’s annual compensation was weighted 12% base

salary, 17% annual incentive award, and 71% long-term

incentive award. Approximately 88% of Mr. Ersek’s 2013

targeted total annual compensation varies based on the

Company’s performance.

In February 2013, the Compensation Committee set

Mr. Ersek’s 2013 compensation levels, including his

annual and long-term incentive award targets, as

discussed below. In determining Mr. Ersek’s 2013 target

compensation levels, the committee considered Mr. Ersek’s

2012 performance and the market data. Mr. Ersek’s