Western Union 2013 Annual Report Download - page 248

Download and view the complete annual report

Please find page 248 of the 2013 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2013 FORM 10-K

THE WESTERN UNION COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

138

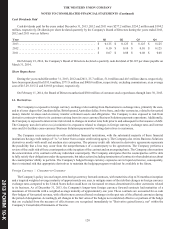

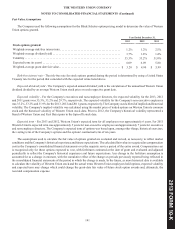

16. Stock Compensation Plans

Stock Compensation Plans

The Western Union Company 2006 Long-Term Incentive Plan

The Western Union Company 2006 Long-Term Incentive Plan ("2006 LTIP") provides for the granting of stock options,

restricted stock units, unrestricted stock awards and other equity-based awards to employees and others who perform services for

the Company. A maximum of 120.0 million shares of common stock may be awarded under the 2006 LTIP, of which 34.0 million

shares are available as of December 31, 2013.

Options granted under the 2006 LTIP are issued with exercise prices equal to the fair market value of Western Union common

stock on the grant date, have 10-year terms, and typically vest over four equal annual increments beginning 12 months after the

date of grant, with the exception of options granted to retirement eligible employees, which will vest on a prorated basis, upon

termination. Compensation expense related to stock options is recognized over the requisite service period.

Restricted stock awards and units granted under the 2006 LTIP typically become 100% vested on the three year anniversary

of the grant date, with the exception of restricted stock units granted to retirement eligible employees, which will vest on a prorated

basis, upon termination. The fair value of the awards granted is measured based on the fair value of the shares on the date of grant.

Certain share unit grants do not provide for the payment of dividend equivalents. For those grants, the value of the grants is reduced

by the net present value of the foregone dividend equivalent payments. The related compensation expense is recognized over the

requisite service period, which is the same as the vesting period.

The compensation committee of the Company's Board of Directors has also granted the Company's executives and other key

employees long-term incentive awards under the 2006 LTIP which consist of approximately two-thirds performance based restricted

stock unit awards and approximately one-third stock option awards. The performance based restricted stock units are restricted

stock awards. The grant date fair value is fixed and the amount of restricted stock units released depends upon certain financial

and strategic performance objectives being met over a two-year period plus an additional vesting period after the two-year

performance period. For the 2012 awards, achievement is also limited if certain total shareholder return metrics are not met over

a three-year period. The actual number of performance based restricted stock units that the recipients receive ranges from 0% up

to 300% of the target number of stock units granted under the LTIP. The performance-based restricted stock units granted in 2013

are restricted stock units, primarily granted to the Company's executives, which require certain financial objectives to be met

during 2013 and 2014 plus an additional vesting period and are subject to a payout modifier based on the Company's relative total

shareholder return over a three year performance period (2013 through 2015). Additionally, the compensation committee granted

non-executive employees of the Company participating in the 2006 LTIP annual equity grants of two-thirds restricted stock units

and one-third stock option awards, or all restricted stock units depending on their employment grade level.

In 2012, the Company started granting bonus stock units out of the 2006 LTIP to the non-employee directors of the Company.

Since bonus stock units vest immediately, compensation expense is recognized on the date of grant based on the fair value of the

awards when granted. These awards may be settled immediately unless the participant elects to defer the receipt of common shares

under the applicable plan rules.