Western Union 2013 Annual Report Download - page 235

Download and view the complete annual report

Please find page 235 of the 2013 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2013 FORM 10-K

THE WESTERN UNION COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

125

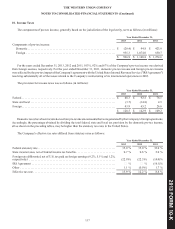

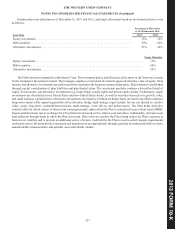

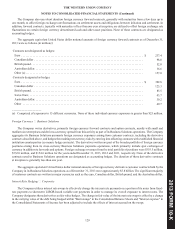

(a) Funds included herein have redemption frequencies of daily to monthly, with redemption notice periods of one to ten business

days.

(b) Substantially all corporate debt securities are investment grade securities.

(c) Hedge funds generally hold liquid and readily priceable securities, such as public equities, exchange-traded derivatives, and

corporate bonds. Hedge funds themselves do not have readily available market quotations, and therefore are valued using

the Net Asset Value ("NAV") per share provided by the investment sponsor or third party administrator. Funds investing in

diverse hedge fund strategies (primarily commingled funds) had the following composition of underlying hedge fund

investments within the pension plan at December 31, 2013: relative value (24%), equity long/short (21%), commodities/

currencies (20%), multi-strategy (13%), event driven (12%), and global-macro (10%). As of December 31, 2013, funds

included herein had redemption frequencies of monthly to quarterly, with redemption notice periods of three to 60 days.

(d) Diversified investments in royalty rights related to the sale of pharmaceutical products by third parties. Also included are

private equity funds with a focus on venture capital. These investments are illiquid, with investment distributions expected

to be received over the lives of the funds, which are uncertain but based on the voting rights of investors and the maturities

of the underlying investments.

The maturities of debt securities as of December 31, 2013 range from less than one year to approximately 32 years with a

weighted-average maturity of 14 years.

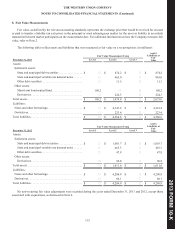

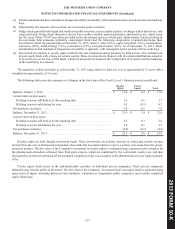

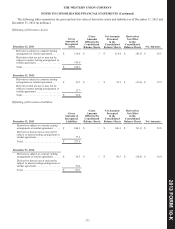

The following tables provide summaries of changes in the fair value of the Trust's Level 3 financial assets (in millions):

Royalty

Rights

Private

Equity Total

Balance, January 1, 2012. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 11.4 $ 2.2 $ 13.6

Actual return on plan assets:

Relating to assets still held as of the reporting date . . . . . . . . . . . . . . . . . . . . . . . . 1.6 0.1 1.7

Relating to assets sold during the year . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0.8 (0.1) 0.7

Net purchases and sales . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7.6 0.2 7.8

Balance, December 31, 2012. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 21.4 $ 2.4 $ 23.8

Actual return on plan assets:

Relating to assets still held as of the reporting date . . . . . . . . . . . . . . . . . . . . . . . . 2.3 0.3 2.6

Relating to assets sold during the year . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1.6 0.1 1.7

Net purchases and sales . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (2.0)(0.2)(2.2)

Balance, December 31, 2013. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 23.3 $ 2.6 $ 25.9

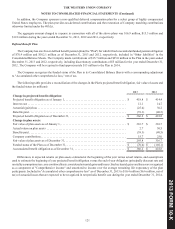

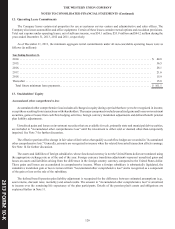

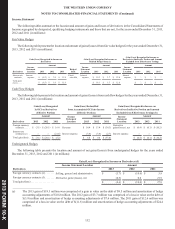

Royalty rights are held through investment funds. These investments are priority interests in contractual royalty revenue

derived from the sale of pharmaceutical products that entitle the investment fund to receive a portion of revenue from the patent-

protected product. The fair value of the Company's investment in royalty rights is estimated using consensus sales estimates for

the pharmaceutical products obtained from third-party experts, which are multiplied by the contractual royalty rate, and then

discounted by an interest rate based off the estimated weighted average cost of capital of the pharmaceutical sector (approximately

10%).

Private equity funds invest in the non-marketable securities of individual private companies. These private companies

ultimately may become public in the future. The fair value of the Company's investment in private equity funds is estimated using

many types of inputs, including historical sales multiples, valuations of comparable public companies, and recently completed

equity financings.