Western Union 2013 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2013 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

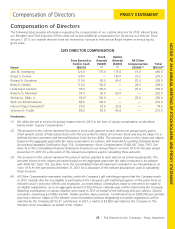

31 | The Western Union Company – Proxy Statement

NOTICE OF 2014 ANNUAL MEETING OF STOCKHOLDERS AND PROXY STATEMENT

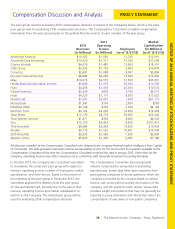

Compensation Discussion and Analysis PROXY STATEMENT

Recent Compensation Actions

For 2013, many of the compensation decisions were

designed to further align the program with the Company’s

mid- and long-term operating plans, increase participant

accountability, and drive motivation and retention beyond

2013. These decisions included:

• No Executive Base Salary Increases for 2013 or

2014: There was no change in our named executive

officers’ base salary levels for 2013 or 2014 from levels

effective March 2012.

• No 2012 Chief Executive Officer Bonus: Based

on 2012 Company performance, our Chief Executive

Officer did not receive a bonus in 2013.

• 2013 Annual Incentive Includes Restricted

Stock Unit Component: In 2013, we modified the

Company’s Annual Incentive Plan design to include

individual and/or business unit performance objectives,

and a restricted stock unit award to be granted

based on the achievement of strategic objectives

and a threshold operating income goal to further

focus participants on the long-term performance of

the Company.

• 2013 Long-Term Incentive Includes TSR Modifier:

We modified the Long-Term Incentive Plan design to

include 2013 and 2014 financial performance metrics,

while still maintaining a longer-term perspective in the

program with a TSR payout modifier.

• Realizable Compensation Lower than Reported

Compensation: Our named executive officers’

realizable compensation has been lower than

the compensation disclosed in our Summary

Compensation Table for fiscal years 2011 to 2013.

See the “2013 Realizable Compensation Table” on

page 42.

Chief Executive Officer Compensation

For 2013 performance, Mr. Ersek received a cash payout

under the 2013 Annual Incentive Plan of 84% of target,

as compared to no payout for 2012 performance. Because

he is the leader of the Company, the Compensation

Committee based Mr. Ersek’s cash opportunity under

the Annual Incentive Plan entirely on the achievement of

corporate financial goals, as measured by total revenue

and operating income. In 2013, the Compensation

Committee adjusted the performance targets associated

with these performance measures from the levels set

in 2012 to reflect that many of the strategic actions

implemented by the Company beginning in late 2012 were

designed to position the Company for future growth,

and were expected to have a negative impact on 2013

financial performance. The Company achieved revenue

and operating income at 99.5% and 10 0.1% of target,

respectively, for an overall cash payout achievement level

of 84%.

Also, under the 2013 Annual Incentive Plan, Mr. Ersek had

an opportunity to receive a restricted stock unit award

for various levels of achievement of strategic performance

objectives. Achievement of the Company’s internal

operating plan for these strategic objectives would result

in a restricted stock unit payout equal to 25% of target

and maximum achievement would result in a payout

equal to 75% of target. Mr. Ersek substantially met key

objectives in support of the Company’s 2013 strategic

objectives, as demonstrated by consumer-to-consumer

transaction growth, revenue growth in electronic

channels, and growth in business-to-business revenue

described under ”-Executive Summary – Business

Overview” above, and under “-The Western Union

Executive Compensation Program – Annual Incentive

Compensation,” below. Accordingly, the committee

certified a restricted stock unit award payout under the

2013 Annual Incentive Plan of 17% of target, based on the

Company’s achievement of its strategic performance goals

(versus a payout of 25% of target that would have been

paid had the Company achieved its internal plan for its

strategic performance goals).