Western Union 2013 Annual Report Download - page 219

Download and view the complete annual report

Please find page 219 of the 2013 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2013 FORM 10-K

THE WESTERN UNION COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

109

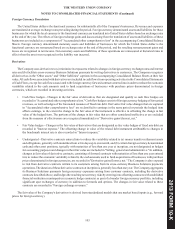

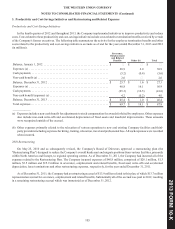

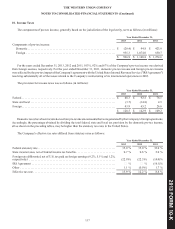

5. Commitments and Contingencies

Letters of Credit and Bank Guarantees

The Company had approximately $100 million in outstanding letters of credit and bank guarantees as of December 31, 2013

with expiration dates through 2016, the majority of which contain a one-year renewal option. The letters of credit and bank

guarantees are primarily held in connection with lease arrangements and certain agent agreements. The Company expects to renew

the letters of credit and bank guarantees prior to expiration in most circumstances.

Litigation and Related Contingencies

The Company and one of its subsidiaries are defendants in two purported class action lawsuits: James P. Tennille v. The

Western Union Company and Robert P. Smet v. The Western Union Company, both of which are pending in the United States

District Court for the District of Colorado. The original complaints asserted claims for violation of various consumer protection

laws, unjust enrichment, conversion and declaratory relief, based on allegations that the Company waits too long to inform

consumers if their money transfers are not redeemed by the recipients and that the Company uses the unredeemed funds to generate

income until the funds are escheated to state governments. The Tennille complaint was served on the Company on April 27, 2009.

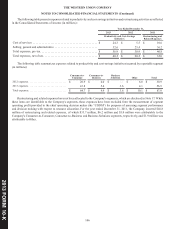

The Smet complaint was served on the Company on April 6, 2010. On September 21, 2009, the Court granted the Company's

motion to dismiss the Tennille complaint and gave the plaintiff leave to file an amended complaint. On October 21, 2009, Tennille

filed an amended complaint. The Company moved to dismiss the Tennille amended complaint and the Smet complaint. On

November 8, 2010, the Court denied the motion to dismiss as to the plaintiffs' unjust enrichment and conversion claims. On

February 4, 2011, the Court dismissed the plaintiffs' consumer protection claims. On March 11, 2011, the plaintiffs filed an amended

complaint that adds a claim for breach of fiduciary duty, various elements to its declaratory relief claim and Western Union Financial

Services, Inc. ("WUFSI"), a subsidiary of the Company, as a defendant. On April 25, 2011, the Company and WUFSI filed a

motion to dismiss the breach of fiduciary duty and declaratory relief claims. WUFSI also moved to compel arbitration of the

plaintiffs' claims and to stay the action pending arbitration. On November 21, 2011, the Court denied the motion to compel arbitration

and the stay request. Both companies appealed the decision. On January 24, 2012, the United States Court of Appeals for the Tenth

Circuit granted the companies' request to stay the District Court proceedings pending their appeal. During the fourth quarter of

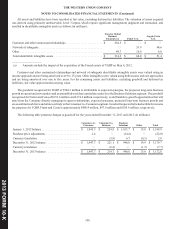

2012, the parties executed a settlement agreement, which the Court preliminarily approved on January 3, 2013. On June 25, 2013,

the Court entered an order certifying the class and granting final approval to the settlement. Under the approved settlement, a

substantial amount of the settlement proceeds, as well as all of the class counsel’s fees, administrative fees and other expenses,

would be paid from the class members' unclaimed money transfer funds, which are included within "Settlement obligations" in

the Company's consolidated balance sheets. During the final approval hearing, the Court overruled objections to the settlement

that had been filed by several class members. In July 2013, two of those class members filed notices of appeal. The United States

Court of Appeals for the Tenth Circuit has scheduled oral argument for March 18, 2014. The settlement requires Western Union

to deposit the class members' unclaimed money transfer funds into a class settlement fund, from which class member claims,

administrative fees and class counsel’s fees, as well as other expenses will be paid. On November 6, 2013, the Attorney General

of California notified Western Union of the California Controller’s position that Western Union’s deposit of the unclaimed money

transfer funds into the class settlement fund pursuant to the settlement “will not satisfy Western Union’s obligations to report and

remit funds” under California’s unclaimed property law, and that “Western Union will remain liable to the State of California” for

the funds that would have escheated to California in the absence of the settlement. The State of Pennsylvania and Washington,

D.C. have expressed similar views. There is thus reason to believe that these and potentially other jurisdictions may bring actions

against the Company seeking reimbursement for amounts equal to the class counsel’s fees, administrative costs and other expenses

that are paid from the class settlement fund. If such actions are brought or claims that may otherwise require Western Union to

incur additional escheatment-related liabilities are asserted, Western Union would defend itself vigorously.