Western Union 2013 Annual Report Download - page 220

Download and view the complete annual report

Please find page 220 of the 2013 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2013 FORM 10-K

THE WESTERN UNION COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

110

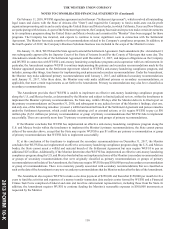

On February 11, 2010, WUFSI signed an agreement and settlement ("Settlement Agreement"), which resolved all outstanding

legal issues and claims with the State of Arizona (the "State") and required the Company to fund a multi-state not-for-profit

organization promoting safety and security along the United States and Mexico border, in which California, Texas and New Mexico

are participating with Arizona. As part of the Settlement Agreement, the Company has made and expects to make certain investments

in its compliance programs along the United States and Mexico border and a monitor (the "Monitor") has been engaged for those

programs. The Company has incurred, and expects to continue to incur, significant costs in connection with the Settlement

Agreement. The Monitor has made a number of recommendations related to the Company's compliance programs. In addition, in

the fourth quarter of 2012, the Company's Business Solutions business was included in the scope of the Monitor's review.

On January 31, 2014, WUFSI and the State agreed to amend the Settlement Agreement. Such amendment (the “Amendment”)

was subsequently approved by the Superior Court of the State of Arizona In and For the County of Maricopa that same day. The

Amendment extends the term of the Settlement Agreement until December 31, 2017, and imposes obligations on the Company

and WUFSI in connection with WUFSI’s anti-money laundering compliance programs and cooperation with law enforcement. In

particular, the Amendment requires WUFSI to continue implementing the primary and secondary recommendations made by the

Monitor appointed pursuant to the Settlement Agreement related to WUFSI’s anti-money laundering compliance program, and

includes, among other things, timeframes for implementing such primary and secondary recommendations. Under the Amendment,

the Monitor may make additional primary recommendations until January 1, 2015, and additional secondary recommendations

until January 31, 2017. After these dates, the Monitor may only make additional primary or secondary recommendations, as

applicable, that meet certain requirements as set forth in the Amendment. Primary recommendations may also be re-classified as

secondary recommendations.

The Amendment provides that if WUFSI is unable to implement an effective anti-money laundering compliance program

along the U.S. and Mexico border, as determined by the Monitor and subject to limited judicial review, within the timeframes to

implement the Monitor’s primary recommendations, the State may, within 180 days after the Monitor delivers its final report on

the primary recommendations on December 31, 2016, and subsequent to any judicial review of the Monitor’s findings, elect one,

and only one, of the following remedies: (i) assert a willful and material breach of the Settlement Agreement and pursue remedies

under the Settlement Agreement, which could include initiating civil or criminal actions; or (ii) require WUFSI to pay (a) $50

million plus (b) $1 million per primary recommendation or group of primary recommendations that WUFSI fails to implement

successfully. There are currently more than 70 primary recommendations and groups of primary recommendations.

If the Monitor concludes that WUFSI has implemented an effective anti-money laundering compliance program along the

U.S. and Mexico border within the timeframes to implement the Monitor’s primary recommendations, the State cannot pursue

either of the remedies above, except that the State may require WUFSI to pay $1 million per primary recommendation or group

of primary recommendations that WUFSI fails to implement successfully.

If, at the conclusion of the timeframe to implement the secondary recommendations on December 31, 2017, the Monitor

concludes that WUFSI has not implemented an effective anti-money laundering compliance program along the U.S. and Mexico

border, the State cannot assert a willful and material breach of the Settlement Agreement but may require WUFSI to pay an

additional $25 million. Additionally, if the Monitor determines that WUFSI has implemented an effective anti-money laundering

compliance program along the U.S. and Mexico border but has not implemented some of the Monitor’s secondary recommendations

or groups of secondary recommendations that were originally classified as primary recommendations or groups of primary

recommendations on the date of the Amendment, the State may require WUFSI to pay $500,000 per such secondary recommendation

or group of recommendations. There is no monetary penalty associated with secondary recommendations that are classified as

such on the date of the Amendment or any new secondary recommendations that the Monitor makes after the date of the Amendment.

The Amendment also requires WUFSI to make a one-time payment of $250,000 and thereafter $150,000 per month for five

years to fund the activities and expenses of a money transfer transaction data analysis center formed by WUFSI and a Financial

Crimes Task Force comprised of federal and state and local law enforcement representatives, including those from the State. In

addition, the Amendment requires WUFSI to continue funding the Monitor’s reasonable expenses in $500,000 increments as

requested by the Monitor.