Western Union 2013 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2013 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

49 | The Western Union Company – Proxy Statement

NOTICE OF 2014 ANNUAL MEETING OF STOCKHOLDERS AND PROXY STATEMENT

Compensation Discussion and Analysis PROXY STATEMENT

revenue and operating income over the course of the

year should be excluded from the award calculation, as

it believed compensation should not be based on factors

outside of the control of our executives.

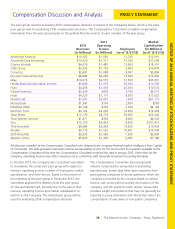

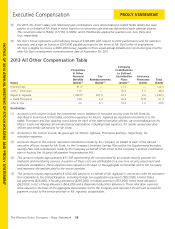

The following table sets forth each named executive officer’s

threshold, target and maximum award opportunities with

respect to the 2013 performance-based restricted stock units:

2013 Performance-Based Restricted Stock Unit Award Opportunity

Executive Threshold Target Maximum

Hikmet Ersek 71,429 271,429 571,430

Scott T. Scheirman(1) 20,938 79,563 167,500

Rajesh K. Agrawal 15,554 59,104 124,430

J. David Thompson 14,357 54,558 114,858

John R. Dye 11,965 45,465 95,716

(1) In connection with his separation from the Company and pursuant to the Separation Agreement, Mr. Scheirman will

receive a prorated payout of the 2013 performance-based restricted stock units based on actual performance.

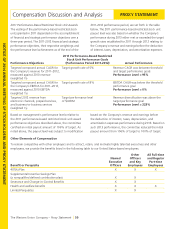

2012 Performance-Based Restricted Stock Unit Awards.

The vesting of the performance-based restricted stock

unit awards granted in 2012 depended upon the

accomplishment of financial and strategic performance

objectives over a two-year period. Under the original terms

of the award agreements, these awards were also subject to

payout modifiers based on TSR and stock price performance

over the 2012-2014 period if the payout level for the

2012-2013 performance goals was equal to or greater than

150% of target. Based on performance relative to the

performance objectives described below, the committee

certified a payout of 17% of target for each of the named

executive officers other than Mr. Ersek. For Mr. Ersek, the

committee exercised negative discretion to certify a payout

of 13% of target. Accordingly, the TSR and stock price

payout modifiers will not be applied, and these awards

remain subject only to time-based vesting requirements

until February 23, 2015. The 2012-2013 financial and

strategic performance objectives, their respective weightings

and the performance level achievement as of the end of the

2012-2013 performance period, are as follows:

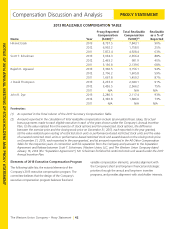

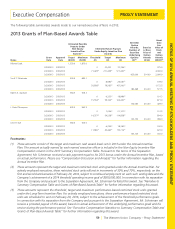

Performance Objectives

2012 Performance-Based Restricted

Stock Unit Performance Goals

(Performance Period 2012-2013) Actual Performance

Targeted compound annual constant

currency growth rate (“CAGR”) for

the Company’s revenue for 2012-

2013, measured against 2011 revenue

(weighted 34%)

Target growth rate of 9% Revenue CAGR was below the threshold

performance goal

Performance Level = 0%

Targeted compound annual CAGR

for the Company’s earnings before

the deduction of interest, taxes,

depreciation, and amortization expenses

(“EBITDA”) for 2012-2013, measured

against 2011 EBITDA (weighted 33%)

Target growth rate of 6% EBITDA CAGR was below the threshold

performance goal

Performance Level = 0%

Targeted compound annual growth

rate for registered customers for

2012-2013, measured against

2011 registered customer levels

(weighted 33%)

Consumer target growth rate of 29%

(weighted 80%)

Business target growth rate of 15%

(weighted 20%)

Registered consumer growth was

between threshold and target

performance goals

Performance Level = 64%

Registered business growth was below

the threshold performance goal

Performance Level = 0%