Western Union 2013 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2013 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

69 | The Western Union Company – Proxy Statement

NOTICE OF 2014 ANNUAL MEETING OF STOCKHOLDERS AND PROXY STATEMENT

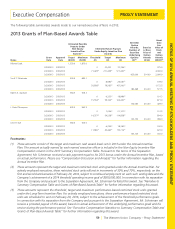

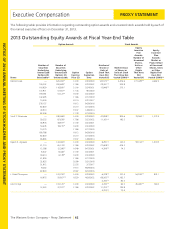

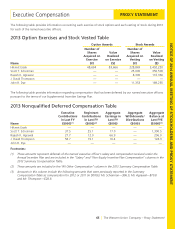

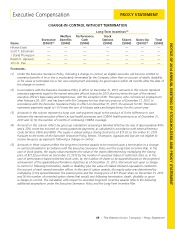

Executive Compensation PROXY STATEMENT

CHANGE-IN-CONTROL WITHOUT TERMINATION

Long-Term Incentives(5)

Name

Severance

($000)(2)

Welfare

Benefits

($000)

Performance

Cash

($000)

Stock

Options

($000)

Shares

($000)

Gross-Up

($000)(4)

Total

($000)

Hikmet Ersek — — — — — — —

Scott T. Scheirman — — — — — — —

J. David Thompson — — — — — — —

Rajesh K. Agrawal — — — — — — —

John R. Dye — — — — — — —

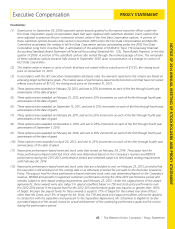

Footnotes:

(1) Under the Executive Severance Policy, following a change-in-control, an eligible executive will become entitled to

severance benefits if he or she is involuntarily terminated by the Company other than on account of death, disability

or for cause or terminates his or her own employment voluntarily for good reason within 24 months after the date of

the change-in-control.

(2) In accordance with the Executive Severance Policy in effect on December 31, 2013, amounts in this column represent

severance payments equal to the named executive officer’s bonus for 2013 plus two times the sum of the named

executive officer’s base salary and target bonus, with the exception of Mr. Thompson, who commenced employment

after February 24, 2011 and has been with the Company for less than two years as of December 31, 2013. In

accordance with the Executive Severance Policy in effect on December 31, 2013, the amount for Mr. Thompson

represents payments equal to 1.67 times the sum of his base salary and target bonus for the current year.

(3) Amounts in this column represent a lump sum cash payment equal to the product of (i) the difference in cost

between the named executive officer’s actual health premiums and COBRA health premiums as of December 31,

2013 and (ii) 18, the number of months of continuing COBRA coverage.

(4) Amounts in this column reflect tax gross-up calculations assuming a blended effective tax rate of approximately 40%

and a 20% excise tax incurred on excess parachute payments, as calculated in accordance with Internal Revenue

Code Sections 280G and 4999. The equity is valued using a closing stock price of $17.25 on December 31, 2013.

Pursuant to the terms of the Executive Severance Policy, Messrs. Thompson, Agrawal and Dye are not eligible to

receive tax-gross up payments following a change-in-control.

(5) Amounts in these columns reflect the long-term incentive awards to be received upon a termination or a change-

in-control calculated in accordance with the Executive Severance Policy and the Long-Term Incentive Plan. In the

case of stock grants, the equity value represents the value of the shares (determined by multiplying the closing

price of $17.25 per share on December 31, 2013 by the number of unvested shares of restricted stock or, in the

case of performance-based restricted stock units, by the number of shares to be awarded based on the projected

achievement of the applicable performance objectives as of December 31, 2013, that would vest upon a change-

in-control or following termination, death or disability) plus the value of related dividend equivalents credited to

the account of each named executive officer. In the case of option awards, the equity value was determined by

multiplying (i) the spread between the exercise price and the closing price of $17.25 per share on December 31, 2013

and (ii) the number of unvested option shares that would vest following termination, death, disability or upon

a change-in-control. The calculation with respect to unvested long-term incentive awards reflects the following

additional assumptions under the Executive Severance Policy and the Long-Term Incentive Plan: