Western Union 2013 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2013 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

33 | The Western Union Company – Proxy Statement

NOTICE OF 2014 ANNUAL MEETING OF STOCKHOLDERS AND PROXY STATEMENT

Compensation Discussion and Analysis PROXY STATEMENT

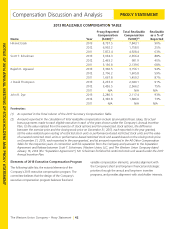

Executive Compensation Framework

The Compensation Committee reviews on an ongoing basis the Company’s executive compensation and benefits programs

to evaluate whether they support the Company’s compensation philosophy and objectives, as described in “-Establishing and

Evaluating Executive Compensation-Our Executive Compensation Philosophy and Objectives” below, and serve the interests

of our stockholders. The Company’s practices include the following, each of which reinforces our executive compensation

philosophy and objectives:

What We Do:

Pay-for-performance. A significant percentage of targeted annual compensation is delivered in the form of

variable compensation that is connected to actual performance. For 2013, variable compensation comprised

approximately 88% of the targeted annual compensation for the Chief Executive Officer and, on average, 78% of

the targeted annual compensation for the other named executive officers.

Linkage between performance measures and strategic objectives. Performance measures for incentive

compensation are linked to both strategic and operating objectives designed to create long-term stockholder value

and to hold executives accountable for their individual performance and the performance of the Company.

Emphasis on future pay opportunity vs. current pay. In 2013, all of the long-term incentive awards delivered

to our named executive officers were in the form of equity-based compensation and the Annual Incentive Plan

included a restricted stock unit component to be delivered if the Company achieved 2013 strategic objectives.

Outside compensation consultant. The Compensation Committee retains its own compensation consultant to

review the Company’s executive compensation program and practices.

“Double trigger” in the event of a change-in-control. In the event of a change-in-control, severance benefits

are payable only upon a “double trigger.”

Maximum payout caps for annual cash incentive compensation and performance-based restricted stock

unit awards.

“Clawback” Policy. The Company may recover incentive compensation paid to an executive officer that was

calculated based upon any financial result or performance metric impacted by fraud or misconduct of the executive

officer.

Robust stock ownership guidelines. Executives are required to hold stock equal to a multiple of five times salary

for our Chief Executive Officer and two times salary for each other named executive officer. Fifty percent of after-tax

shares received as equity compensation must be retained until an executive meets the stock ownership guideline.

What We Don’t Do:

No change-in-control tax gross ups. We do not provide change-in-control tax gross ups to individuals promoted

or hired as executive officers after April 2009.

No repricing or buyout of underwater stock options. None of our equity plans permit the repricing or buyout

of underwater stock options or stock appreciation rights, except in connection with certain corporate transactions

involving the Company.

Prohibition against employee and director pledging and hedging of Company securities.

No dividends or dividend equivalents accrued or paid on performance-based restricted stock

unit awards or time-based restricted stock unit awards.