Western Union 2013 Annual Report Download - page 189

Download and view the complete annual report

Please find page 189 of the 2013 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2013 FORM 10-K

79

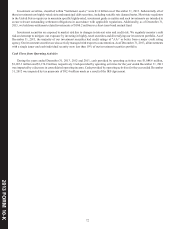

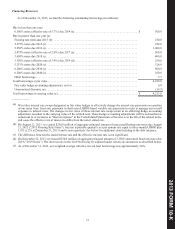

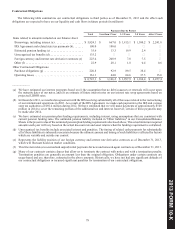

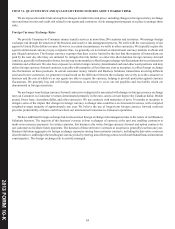

Contractual Obligations

The following table summarizes our contractual obligations to third parties as of December 31, 2013 and the effect such

obligations are expected to have on our liquidity and cash flows in future periods (in millions):

Payments Due by Period

Total Less than 1 Year 1-3 Years 3-5 Years After 5 Years

Items related to amounts included on our balance sheet:

Borrowings, including interest (a) . . . . . . . . . . . . . . . . . . . $ 5,824.1 $ 667.0 $ 1,815.1 $ 1,100.2 $ 2,241.8

IRS Agreement and related state tax payments (b). . . . . . . 100.0 100.0 — — —

Estimated pension funding (c) . . . . . . . . . . . . . . . . . . . . . . 35.6 13.3 19.9 2.4 —

Unrecognized tax benefits (d). . . . . . . . . . . . . . . . . . . . . . . 135.2 — — — —

Foreign currency and interest rate derivative contracts (e) 223.4 208.9 7.0 7.5 —

Other (f) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 22.9 20.1 1.8 0.4 0.6

Other Contractual Obligations:

Purchase obligations (g) . . . . . . . . . . . . . . . . . . . . . . . . . . . 220.8 92.9 89.5 38.4 —

Operating leases . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 161.1 44.0 64.6 37.5 15.0

$ 6,723.1 $ 1,146.2 $ 1,997.9 $ 1,186.4 $ 2,257.4

____________

(a) We have estimated our interest payments based on (i) the assumption that no debt issuances or renewals will occur upon

the maturity dates of our notes, and (ii) an estimate of future interest rates on our interest rate swap agreements based on

projected LIBOR rates.

(b) In December 2011, we reached an agreement with the IRS resolving substantially all of the issues related to the restructuring

of our international operations in 2003. As a result of the IRS Agreement, we made cash payments to the IRS and various

state tax authorities of $92.4 million during 2012. We have estimated that we will make payments of approximately $100

million in 2014 to cover the remaining portion of the additional tax and interest; however, certain of these payments may

be made after 2014.

(c) We have estimated our pension plan funding requirements, including interest, using assumptions that are consistent with

current pension funding rates. The unfunded pension liability included in "Other liabilities" in our Consolidated Balance

Sheets is the present value of the estimated pension plan funding requirements disclosed above. The actual minimum required

amounts each year will vary based on the actual discount rate and asset returns when the funding requirement is calculated.

(d) Unrecognized tax benefits include associated interest and penalties. The timing of related cash payments for substantially

all of these liabilities is inherently uncertain because the ultimate amount and timing of such liabilities is affected by factors

which are variable and outside our control.

(e) Represents the liability position of our foreign currency and interest rate derivative contracts as of December 31, 2013,

which will fluctuate based on market conditions.

(f) This line item relates to accrued and unpaid initial payments for new and renewed agent contracts as of December 31, 2013.

(g) Many of our contracts contain clauses that allow us to terminate the contract with notice and with a termination penalty.

Termination penalties are generally an amount less than the original obligation. Obligations under certain contracts are

usage-based and are, therefore, estimated in the above amounts. Historically, we have not had any significant defaults of

our contractual obligations or incurred significant penalties for termination of our contractual obligations.