Western Union 2013 Annual Report Download - page 211

Download and view the complete annual report

Please find page 211 of the 2013 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2013 FORM 10-K

THE WESTERN UNION COMPANY

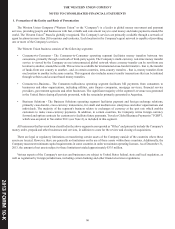

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

101

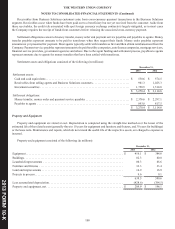

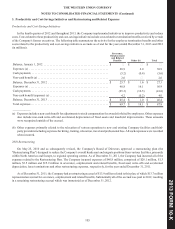

Amounts charged to expense for depreciation of property and equipment were $64.2 million, $61.7 million and $61.0 million

during the years ended December 31, 2013, 2012 and 2011, respectively.

Goodwill

Goodwill represents the excess of purchase price over the fair value of tangible and other intangible assets acquired, less

liabilities assumed arising from business combinations. The Company's annual impairment assessment did not identify any goodwill

impairment during the years ended December 31, 2013, 2012 and 2011.

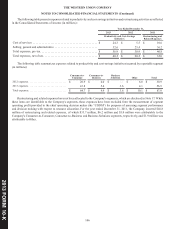

Other Intangible Assets

Other intangible assets primarily consist of acquired contracts, contract costs (primarily amounts paid to agents in connection

with establishing and renewing long-term contracts) and software. Other intangible assets are amortized on a straight-line basis

over the length of the contract or benefit periods. Included in the Consolidated Statements of Income is amortization expense of

$198.6 million, $184.4 million and $131.6 million for the years ended December 31, 2013, 2012 and 2011, respectively.

Acquired contracts include customer and contractual relationships and networks of subagents that are recognized in connection

with the Company's acquisitions.

The Company capitalizes initial payments for new and renewed agent contracts to the extent recoverable through future

operations or penalties in the case of early termination. The Company's accounting policy is to limit the amount of capitalized

costs for a given contract to the lesser of the estimated future cash flows from the contract or the termination fees the Company

would receive in the event of early termination of the contract.

The Company purchases and develops software that is used in providing services and in performing administrative functions.

Software development costs are capitalized once technological feasibility of the software has been established. Costs incurred

prior to establishing technological feasibility are expensed as incurred. Technological feasibility is established when the Company

has completed all planning and designing activities that are necessary to determine that a product can be produced to meet its

design specifications, including functions, features and technical performance requirements. Capitalization of costs ceases when

the product is available for general use. Software development costs and purchased software are generally amortized over a term

of three to five years.

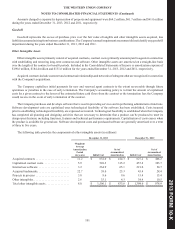

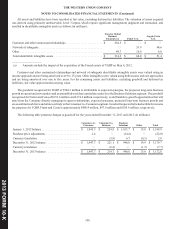

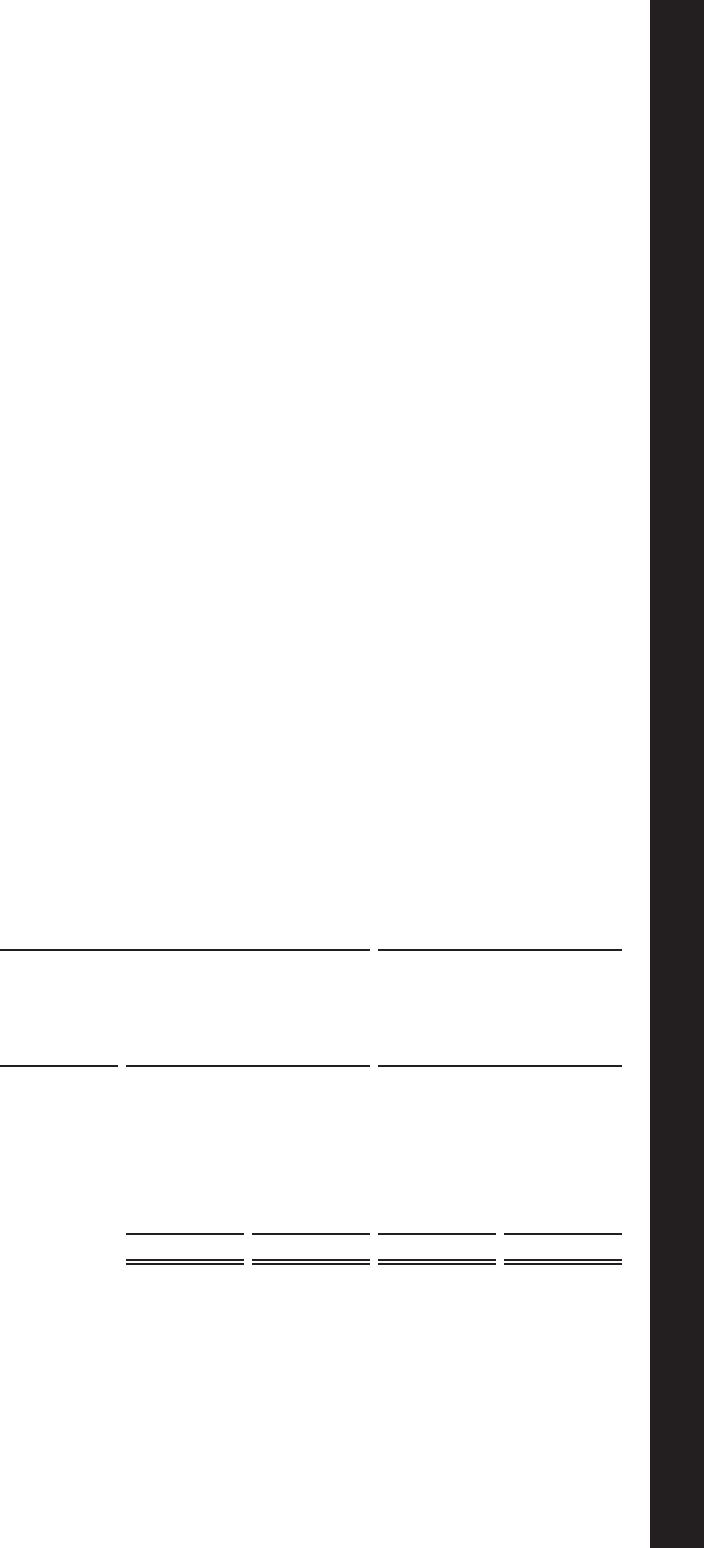

The following table provides the components of other intangible assets (in millions):

December 31, 2013 December 31, 2012

Weighted-

Average

Amortization

Period

(in years) Initial Cost

Net of

Accumulated

Amortization Initial Cost

Net of

Accumulated

Amortization

Acquired contracts . . . . . . . . . . . . . . . . . . . . . . . 11.2 $ 632.0 $ 414.3 $ 627.2 $ 466.2

Capitalized contract costs . . . . . . . . . . . . . . . . . . 5.9 528.5 315.2 457.2 303.7

Internal use software. . . . . . . . . . . . . . . . . . . . . . 3.2 264.9 65.1 221.0 54.7

Acquired trademarks. . . . . . . . . . . . . . . . . . . . . . 22.7 38.0 25.3 43.4 28.4

Projects in process . . . . . . . . . . . . . . . . . . . . . . . 3.0 9.6 9.6 15.4 15.4

Other intangibles . . . . . . . . . . . . . . . . . . . . . . . . . 2.6 33.1 4.3 34.4 10.5

Total other intangible assets . . . . . . . . . . . . . . . . 8.0 $ 1,506.1 $ 833.8 $ 1,398.6 $ 878.9