Western Union 2011 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2011 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

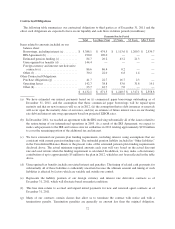

Description Judgments and Uncertainties

Effect if Actual Results Differ from

Assumptions

Goodwill Impairment Testing

An impairment assessment of goodwill

is conducted annually at the reporting

unit level. This assessment of goodwill is

performed more frequently if events or

changes in circumstances indicate that

the carrying value of the goodwill may

not be recoverable.

Reporting units are driven by the level at

which management reviews segment

operating results. In some cases, that

level is the operating segment (e.g.,

consumer-to-consumer money transfer)

and in others it is one level below the

operating segment (e.g., Business

Solutions, which is included in our

global business payments segment).

Our impairment assessment begins with

a qualitative assessment to determine

whether it is more likely than not that the

fair value of a reporting unit is less than

its carrying value. The initial qualitative

assessment includes comparing the

overall financial performance of the

reporting units against the planned

results. Additionally, each reporting

unit’s fair value is assessed under certain

events and circumstances, including

macroeconomic conditions, industry and

market considerations, cost factors, and

other relevant entity-specific events.

If it is determined in the qualitative

assessment that it is more likely than not

that the fair value of a reporting unit is

less than its carrying value, then the

standard two-step quantitative

impairment test is performed. First, the

fair value of the reporting unit is

calculated or determined using

discounted cash flows and is compared to

its carrying value. If the first step

indicates the carrying value exceeds the

fair value of the reporting unit, then the

second step is required. The second step

is to determine the implied fair value of a

reporting unit’s goodwill by allocating

the determined fair value to all the

reporting unit’s assets and liabilities,

including any unrecognized intangible

assets, as if the reporting unit had been

acquired in a business combination. The

remaining fair value of the reporting unit,

if any, is deemed to be the implied fair

value of the goodwill and an impairment

is recognized in an amount equal to the

excess of the carrying amount of

goodwill above its implied fair value.

The determination of the reporting units

and which reporting units to include in

the qualitative assessment requires

significant judgment. Also, all of the

assumptions used in the qualitative

assessment require judgment.

For the quantitative goodwill impairment

test, we calculate the fair value of

reporting units through discounted cash

flow analyses which require us to make

estimates and assumptions including,

among other items, revenue growth

rates, operating margins, and capital

expenditures based on our budgets and

business plans which take into account

expected regulatory, marketplace, and

other economic factors.

We could be required to evaluate the

recoverability of goodwill if we

experience disruptions to the business,

unexpected significant declines in

operating results, a divestiture of a

significant component of our business,

significant declines in market

capitalization or other triggering events.

In addition, as our business or the way

we manage our business changes, our

reporting units may also change.

If an event described above occurs and

causes us to recognize a goodwill

impairment charge, it would impact our

reported earnings in the periods such

charge occurs.

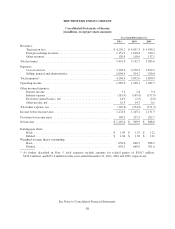

The carrying value of goodwill as of

December 31, 2011 was $3,198.9 million

which represented approximately 35% of

our consolidated assets. As of December

31, 2011, goodwill of $1,945.3 million

and $1,014.7 million resides in our

consumer-to-consumer and Business

Solutions reporting units, respectively.

For the consumer-to-consumer reporting

unit, the fair value of the business greatly

exceeds its carrying amount. TGBP was

recently purchased and represents a

significant majority of the goodwill

related to the Business Solutions

reporting unit. A fair value decline could

occur if actual and forecasted cash flows

do not meet expectations. Such a decline

would likely result in an impairment,

which could be significant.

We have not recorded any goodwill

impairments during the three years

ended December 31, 2011.

78