Western Union 2011 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2011 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE WESTERN UNION COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

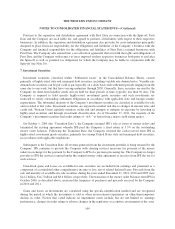

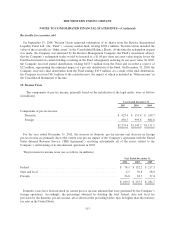

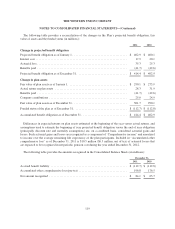

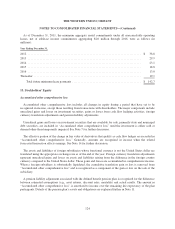

The following table provides a reconciliation of the changes in the Plan’s projected benefit obligation, fair

value of assets and the funded status (in millions):

2011 2010

Change in projected benefit obligation

Projected benefit obligation as of January 1, .................................... $ 402.9 $ 400.1

Interest cost .............................................................. 17.9 20.1

Actuarial loss ............................................................. 35.3 25.3

Benefits paid ............................................................. (41.7) (42.6)

Projected benefit obligation as of December 31, ................................. $ 414.4 $ 402.9

Change in plan assets

Fair value of plan assets as of January 1, ....................................... $ 290.1 $ 275.9

Actual return on plan assets ................................................. 28.3 31.9

Benefits paid ............................................................. (41.7) (42.6)

Company contributions ..................................................... 25.0 24.9

Fair value of plan assets as of December 31, .................................... 301.7 290.1

Funded status of the plan as of December 31, ................................... $ (112.7) $ (112.8)

Accumulated benefit obligation as of December 31, .............................. $ 414.4 $ 402.9

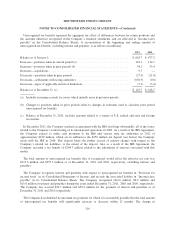

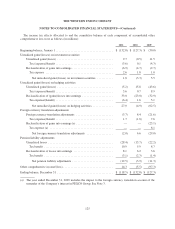

Differences in expected returns on plan assets estimated at the beginning of the year versus actual returns, and

assumptions used to estimate the beginning of year projected benefit obligation versus the end of year obligation

(principally discount rate and mortality assumptions) are, on a combined basis, considered actuarial gains and

losses. Such actuarial gains and losses are recognized as a component of “Comprehensive income” and amortized

to income over the average remaining life expectancy of the plan participants. Included in “Accumulated other

comprehensive loss” as of December 31, 2011 is $10.5 million ($6.5 million, net of tax) of actuarial losses that

are expected to be recognized in net periodic pension cost during the year ended December 31, 2012.

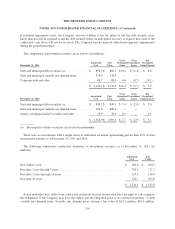

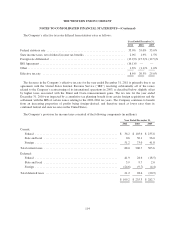

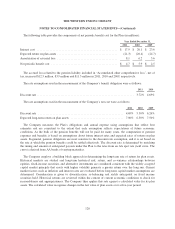

The following table provides the amounts recognized in the Consolidated Balance Sheets (in millions):

December 31,

2011 2010

Accrued benefit liability .................................................... $ (112.7) $ (112.8)

Accumulated other comprehensive loss (pre-tax) ................................. 196.8 176.5

Net amount recognized ..................................................... $ 84.1 $ 63.7

119