Western Union 2011 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2011 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE WESTERN UNION COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

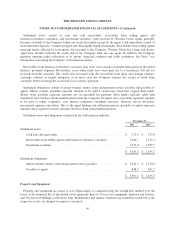

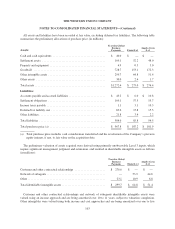

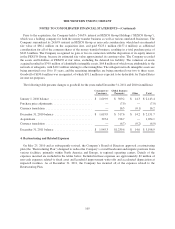

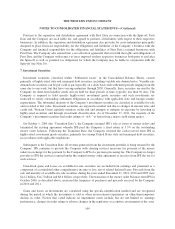

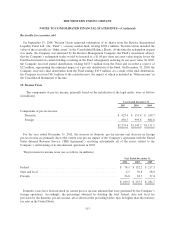

All assets and liabilities have been recorded at fair value, excluding deferred tax liabilities. The following table

summarizes the preliminary allocations of purchase price (in millions):

Assets:

Travelex Global

Business

Payments Finint S.r.l

Angelo Costa

S.r.l

Cash and cash equivalents .................................... $ 40.0 $ — $ —

Settlement assets ........................................... 169.1 52.2 48.0

Property and equipment ...................................... 4.9 0.5 3.0

Goodwill ................................................. 728.7 153.1 172.3

Other intangible assets ....................................... 299.7 64.8 51.4

Other assets ............................................... 30.0 2.4 1.7

Total assets ................................................ $1,272.4 $ 273.0 $ 276.4

Liabilities:

Accounts payable and accrued liabilities ......................... $ 43.2 $ 6.0 $ 10.8

Settlement obligations ....................................... 169.1 57.5 55.7

Income taxes payable ........................................ 1.1 3.1 10.3

Deferred tax liability, net ..................................... 69.4 15.8 15.5

Other liabilities ............................................. 21.8 3.4 2.2

Total liabilities ............................................. 304.6 85.8 94.5

Total purchase price (a) ...................................... $ 967.8 $ 187.2 $ 181.9

(a) Total purchase price includes cash consideration transferred and the revaluation of the Company’s previous

equity interest, if any, to fair value on the acquisition date.

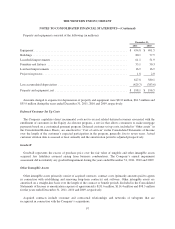

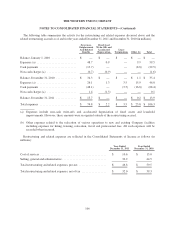

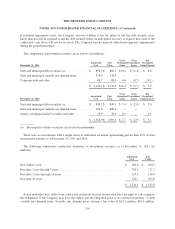

The preliminary valuation of assets acquired were derived using primarily unobservable Level 3 inputs, which

require significant management judgment and estimation, and resulted in identifiable intangible assets as follows

(in millions):

Travelex Global

Business

Payments Finint S.r.l

Angelo Costa

S.r.l

Customer and other contractual relationships ..................... $ 276.6 $ — $ —

Network of subagents ........................................ — 53.9 44.6

Other ..................................................... 23.1 10.9 6.8

Total identifiable intangible assets .............................. $ 299.7 $ 64.8 $ 51.4

Customer and other contractual relationships and network of subagents identifiable intangible assets were

valued using an income approach and are being amortized over 10 to 11 years, subject to valuation completion.

Other intangibles were valued using both income and cost approaches and are being amortized over one to five

103