Western Union 2011 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2011 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE WESTERN UNION COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

writes to its customers, and typically hedges the net exposure through offsetting contracts with established

financial institution counterparties (economic hedge contract) as part of a broader foreign currency

portfolio, including significant spot exchanges of currency in addition to forwards and options. The

changes in fair value related to these contracts are recorded in “Foreign exchange revenues.”

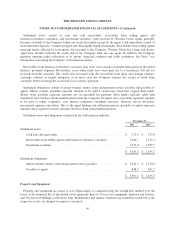

The fair value of the Company’s derivatives is derived from standardized models that use market based inputs

(e.g., forward prices for foreign currency).

The details of each designated hedging relationship are formally documented at the inception of the

arrangement, including the risk management objective, hedging strategy, hedged item, specific risks being

hedged, the derivative instrument, how effectiveness is being assessed and how ineffectiveness, if any, will be

measured. The derivative must be highly effective in offsetting the changes in cash flows or fair value of the

hedged item, and effectiveness is evaluated quarterly on a retrospective and prospective basis.

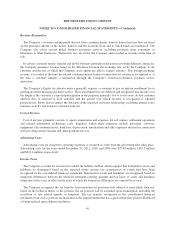

Stock-Based Compensation

The Company currently has a stock-based compensation plan that provides for grants of Western Union stock

options, restricted stock awards and restricted stock units to employees who perform services for the Company.

In addition, the Company has a stock-based compensation plan that provides for grants of Western Union stock

options and stock unit awards to non-employee directors of the Company. Prior to the Spin-off, employees of

Western Union participated in First Data’s stock-based compensation plans.

All stock-based compensation to employees is required to be measured at fair value and expensed over the

requisite service period and also requires an estimate of forfeitures when calculating compensation expense. The

Company recognizes compensation expense on awards on a straight-line basis over the requisite service period

for the entire award. Refer to Note 16 for additional discussion regarding details of the Company’s stock-based

compensation plans.

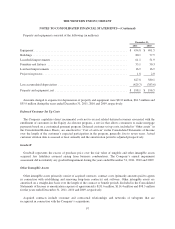

Restructuring and Related Expenses

The Company records severance-related expenses once they are both probable and estimable in accordance

with the provisions of the applicable accounting guidance for severance provided under an ongoing benefit

arrangement. One-time, involuntary benefit arrangements and other exit costs are generally recognized when the

liability is incurred. Expenses arising under the Company’s defined benefit pension plans from curtailing future

service of employees participating in the plans and providing enhanced benefits are recognized in earnings when

it is probable and reasonably estimable. The Company also evaluates impairment issues associated with

restructuring activities when the carrying amount of the assets may not be fully recoverable, in accordance with

the appropriate accounting guidance. Restructuring and related expenses consist of direct and incremental

expenses associated with restructuring and related activities, including severance, outplacement and other

employee related benefits; facility closure and migration of the Company’s IT infrastructure; and other expenses

related to the relocation of various operations to new or existing Company facilities and third-party providers,

including hiring, training, relocation, travel and professional fees. Also included in the facility closure expenses

are non-cash expenses related to fixed asset and leasehold improvement write-offs and accelerated depreciation

at impacted facilities. For more information on the Company’s restructuring and related expenses, see Note 4.

101