Western Union 2011 Annual Report Download - page 152

Download and view the complete annual report

Please find page 152 of the 2011 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE WESTERN UNION COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

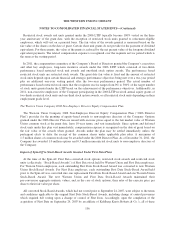

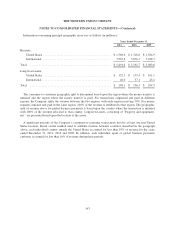

(b) The second quarter includes a gain of $29.4 million, recognized in connection with the remeasurement of

the Company’s former equity interest in Costa to fair value. The fourth quarter includes a net gain of $20.8

million recorded on derivative contracts, consisting of foreign currency forward contracts with maturities of

less than one year, entered into to reduce the economic variability related to the cash amounts used to fund

acquisitions of businesses with purchase prices denominated in foreign currencies, primarily for the TGBP

acquisition. The fourth quarter also includes a gain of $20.5 million, recognized in connection with the

remeasurement of the Company’s former equity interest in Finint to fair value.

(c) In December 2011, the Company reached an agreement with the IRS resolving substantially all of the issues

related to the Company’s restructuring of its international operations in 2003. As a result of the IRS

Agreement, the Company recognized a tax benefit of $204.7 million in the fourth quarter related to the

adjustment of reserves associated with this matter.

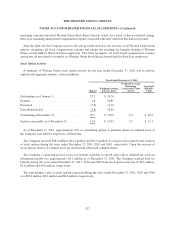

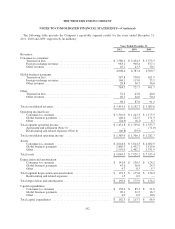

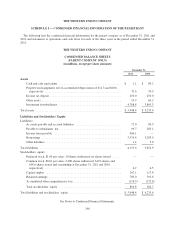

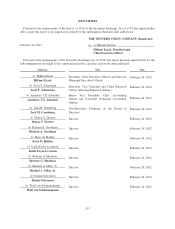

2010 by Quarter: Q1 Q2 Q3 Q4

Year Ended

December 31,

2010

Revenues ............................ $ 1,232.7 $ 1,273.4 $ 1,329.6 $ 1,357.0 $ 5,192.7

Expenses (d) .......................... 916.9 962.4 978.4 1,034.9 3,892.6

Operating income ...................... 315.8 311.0 351.2 322.1 1,300.1

Other expense, net ..................... 39.8 38.7 42.6 33.8 154.9

Income before income taxes ............. 276.0 272.3 308.6 288.3 1,145.2

Provision for income taxes .............. 68.1 51.3 70.2 45.7 235.3

Net income ........................... $ 207.9 $ 221.0 $ 238.4 $ 242.6 $ 909.9

Earnings per share:

Basic ........................... $ 0.30 $ 0.33 $ 0.36 $ 0.37 $ 1.37

Diluted .......................... $ 0.30 $ 0.33 $ 0.36 $ 0.37 $ 1.36

Weighted-average shares outstanding:

Basic ........................... 681.9 669.3 659.1 655.4 666.5

Diluted .......................... 684.2 671.6 661.3 658.4 668.9

(d) Includes $34.5 million in the second quarter, $14.0 million in the third quarter and $11.0 million in the

fourth quarter of restructuring and related expenses. For more information, see Note 4.

145