Western Union 2011 Annual Report Download - page 55

Download and view the complete annual report

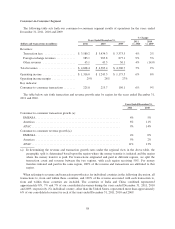

Please find page 55 of the 2011 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.• Our operating income margin was 25% during the year ended December 31, 2011, which is flat year-over-

year. These results include the restructuring and related expenses mentioned above.

• We completed three acquisitions in the year ended December 31, 2011:

• In April 2011, we completed the acquisition of one of our largest agents, European-based Angelo

Costa, S.r.l. (“Costa”), for cash consideration of $135.7 million. We recognized a pre-tax gain of $29.4

million in connection with the remeasurement of our former equity interest in Costa to fair value.

• In October 2011, we completed the acquisition of one of our largest agents, European-based Finint

S.r.l. (“Finint”), for cash consideration of $139.4 million. We recognized a pre-tax gain of $20.5

million in connection with the remeasurement of our former equity interest in Finint to fair value.

• In November 2011, we completed the acquisition of the business-to-business payment business known

as TGBP from Travelex Holdings Limited for cash consideration of $967.8 million.

• In December 2011, we reached an agreement with the United States Internal Revenue Service (“IRS

Agreement”) resolving substantially all of the issues related to the restructuring of our international

operations in 2003. As a result of the IRS Agreement, we recognized a tax benefit of $204.7 million

related to the adjustment of reserves associated with this matter.

• Consolidated net income was $1,165.4 million and $909.9 million for the years ended December 31, 2011

and 2010, respectively, representing a year-over-year increase of 28%. In addition to the tax benefit

described above, the results include $32.0 million and $39.3 million in restructuring and related expense,

net of tax, respectively. Additionally, for 2011, we recognized gains of $12.7 million and $18.3 million,

net of tax, related to our acquisitions of Finint and Costa, respectively, and $13.5 million, net of tax,

related to foreign currency forward contracts entered into to reduce the economic variability related to the

cash amounts used to fund acquisitions of businesses with purchase prices denominated in foreign

currencies, primarily for the TGBP acquisition.

• Our consumers transferred $81 billion and $76 billion in consumer-to-consumer principal for the years

ended December 31, 2011 and 2010, respectively, of which $73 billion and $69 billion related to cross-

border principal, which represented an increase of 7% in both consumer-to-consumer principal and cross-

border principal over the prior year.

• Consolidated cash flows provided by operating activities were $1,174.9 million and $994.4 million for the

years ended December 31, 2011 and 2010, respectively. Cash flows provided by operating activities in

2010 were impacted by a $250 million tax deposit we made relating to United States federal tax liabilities,

including those arising from our 2003 international restructuring, which have been previously accrued for

in our consolidated financial statements.

Our strategic priorities for ensuring our long-term success include accelerating profitable growth in our retail

channels, developing new products and services for our consumers, including expanding our electronic channel

offerings to offer more choice and gain new consumers, expanding our business-to-business payments solutions,

and improving our processes and productivity to help drive growth and improve our profitability. Significant

factors affecting our financial condition and results of operations include:

• Transaction volume is the primary generator of revenue in our businesses. Transaction volume in our

consumer-to-consumer segment is affected by, among other things, the size of the international migrant

population and individual needs to transfer funds in emergency situations. As noted elsewhere in this

Annual Report on Form 10-K, a reduction in the size of the migrant population, interruptions in migration

48