Western Union 2011 Annual Report Download - page 130

Download and view the complete annual report

Please find page 130 of the 2011 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE WESTERN UNION COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

and therefore are valued using the NAV per share provided by the investment sponsor or third party

administrator. Funds investing in diverse hedge fund strategies (primarily commingled funds) with the

following composition of underlying hedge fund investments within the pension plans at

December 31, 2011: commodities/currencies (34%), equity long/short (20%), relative value (17%), multi-

strategy (11%), event driven (10%), and global-macro (8%). There are no redemption restrictions, and

redemptions can generally be done monthly or quarterly with required notice ranging from one to 45 days.

(c) Diversified investments in royalty rights related to the sale of pharmaceutical and biotechnology products by

third parties. Also included are private equity funds with a focus on venture capital and mezzanine financing

strategies.

The maturities of debt securities as of December 31, 2011 range from less than one year to approximately

38 years with a weighted-average maturity of 15 years.

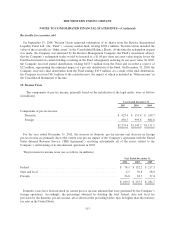

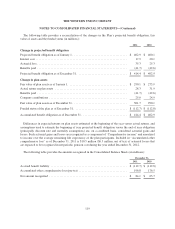

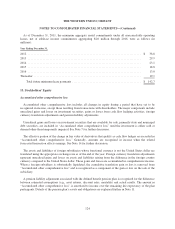

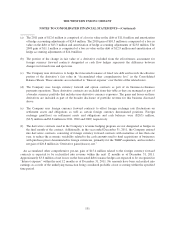

The following tables provide summaries of changes in the fair value of the Trust’s Level 3 financial assets (in

millions):

Royalty

Rights

Private

Equity Total

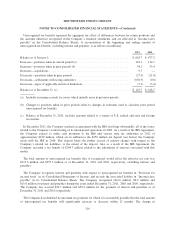

Balance, January 1, 2010 ............................................... $ — $ 2.0 $ 2.0

Actual return on plan assets:

Relating to assets still held as of the reporting date ...................... — (0.4) (0.4)

Relating to assets sold during the period ............................... — 0.2 0.2

Net purchases and sales ................................................ — (0.5) (0.5)

Balance, December 31, 2010 ............................................ $ — $ 1.3 $ 1.3

Actual return on plan assets:

Relating to assets still held as of the reporting date ...................... — (0.8) (0.8)

Relating to assets sold during the period ............................... — 0.9 0.9

Net purchases and sales ................................................ 11.4 0.8 12.2

Balance, December 31, 2011 ............................................ $ 11.4 $ 2.2 $ 13.6

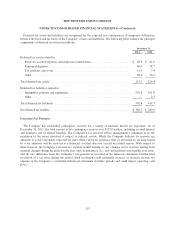

The estimated undiscounted future benefit payments are expected to be $40.4 million in 2012, $39.0 million in

2013, $37.5 million in 2014, $36.0 million in 2015, $34.5 million in 2016 and $147.2 million in 2017 through

2021.

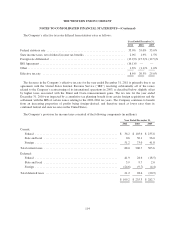

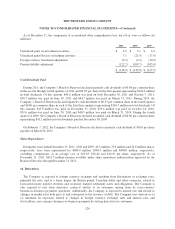

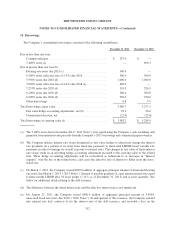

12. Operating Lease Commitments

The Company leases certain real properties for use as customer service centers and administrative and sales

offices. The Company also leases data communications terminals, computers and office equipment. Certain of

these leases contain renewal options and escalation provisions. Total rent expense under operating leases, net of

sublease income, was $44.2 million, $34.7 million and $34.0 million during the years ended December 31, 2011,

2010 and 2009, respectively.

123