Western Union 2011 Annual Report Download - page 135

Download and view the complete annual report

Please find page 135 of the 2011 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE WESTERN UNION COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

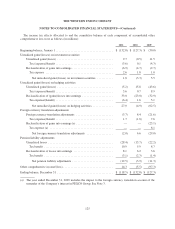

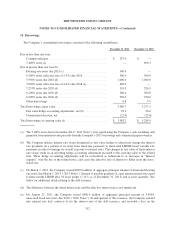

Foreign Currency—Global Business Payments

The Company writes derivatives, primarily foreign currency forward contracts and option contracts, mostly

with small and medium size enterprises and derives a currency spread from this activity as part of its global

business payments operations. The Company aggregates its global business payments foreign currency exposures

arising from customer contracts, including the derivative contracts described above, and hedges the resulting net

currency risks by entering into offsetting contracts with established financial institution counterparties (economic

hedge contracts). The derivatives written are part of the broader portfolio of foreign currency positions arising

from its cross-currency business-to-business payments operations, which primarily include spot exchanges of

currency in addition to forwards and options. Foreign exchange revenues from the total portfolio of positions

were $154.6 million, $105.0 million, and $28.8 million for the years ended December 31, 2011, 2010 and 2009,

respectively. None of the derivative contracts used in global business payments operations are designated as

accounting hedges. The duration of these derivative contracts is generally nine months or less.

The aggregate equivalent United States dollar notional amounts of foreign currency derivative customer

contracts held by the Company in its global business payments operations as of December 31, 2011 were

approximately $3.3 billion. The significant majority of customer contracts are written in major currencies such as

the euro, Canadian dollar, British pound, and Australian dollar.

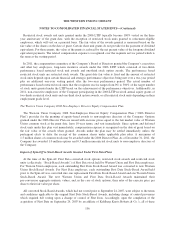

The Company has forward contracts to offset foreign exchange rate fluctuations on a Canadian dollar denominated

intercompany loan. These contracts, which are not designated as accounting hedges, had a notional amount of

approximately 240 million and 245 million Canadian dollars as of December 31, 2011 and 2010, respectively.

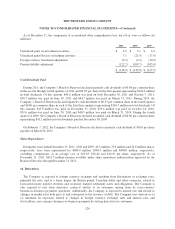

Interest Rate Hedging—Corporate

The Company utilizes interest rate swaps to effectively change the interest rate payments on a portion of its

notes from fixed-rate payments to short-term LIBOR-based variable rate payments in order to manage its overall

exposure to interest rates. The Company designates these derivatives as fair value hedges utilizing the short-cut

method, which permits an assumption of no ineffectiveness if certain criteria are met. The change in fair value of

the interest rate swaps is offset by a change in the carrying value of the debt being hedged within the Company’s

“Borrowings” in the Consolidated Balance Sheets and “Interest expense” in the Consolidated Statements of

Income has been adjusted to include the effects of interest accrued on the swaps.

The Company, at times, utilizes derivatives to hedge the forecasted issuance of fixed rate debt. These

derivatives are designated as cash flow hedges of the variability in the fixed rate coupon of the debt expected to

be issued. The effective portion of the change in fair value of the derivatives is recorded in “Accumulated other

comprehensive loss.”

As of December 31, 2011 and 2010, the Company held interest rate swaps in an aggregate notional amount of

$500.0 million and $1,195.0 million, respectively. The aggregate notional amount held at December 31, 2011

related to notes due in 2014.

128