Western Union 2011 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2011 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

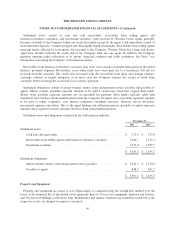

THE WESTERN UNION COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

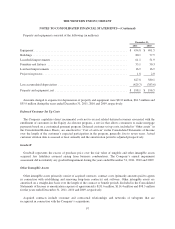

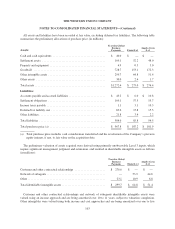

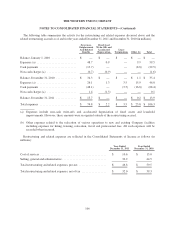

Property and equipment consisted of the following (in millions):

December 31,

2011 2010

Equipment ............................................................... $ 434.8 $ 401.5

Buildings ................................................................ 80.1 77.5

Leasehold improvements .................................................... 61.1 51.9

Furniture and fixtures ...................................................... 33.1 30.3

Land and improvements .................................................... 16.9 16.9

Projects in process ......................................................... 1.8 2.0

627.8 580.1

Less accumulated depreciation ............................................... (429.7) (383.6)

Property and equipment, net ................................................. $ 198.1 $ 196.5

Amounts charged to expense for depreciation of property and equipment were $61.0 million, $61.5 million and

$55.9 million during the years ended December 31, 2011, 2010 and 2009, respectively.

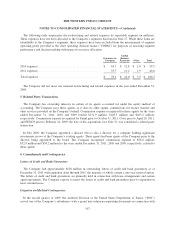

Deferred Customer Set Up Costs

The Company capitalizes direct incremental costs not to exceed related deferred revenues associated with the

enrollment of customers in the Equity Accelerator program, a service that allows consumers to make mortgage

payments based on a customized payment program. Deferred customer set up costs, included in “Other assets” in

the Consolidated Balance Sheets, are amortized to “Cost of services” in the Consolidated Statements of Income

over the length of the customer’s expected participation in the program, generally five to seven years. Actual

customer attrition data is assessed at least annually and the amortization period is adjusted prospectively.

Goodwill

Goodwill represents the excess of purchase price over the fair value of tangible and other intangible assets

acquired, less liabilities assumed arising from business combinations. The Company’s annual impairment

assessment did not identify any goodwill impairment during the years ended December 31, 2011, 2010 and 2009.

Other Intangible Assets

Other intangible assets primarily consist of acquired contracts, contract costs (primarily amounts paid to agents

in connection with establishing and renewing long-term contracts) and software. Other intangible assets are

amortized on a straight-line basis over the length of the contract or benefit periods. Included in the Consolidated

Statements of Income is amortization expense of approximately $131.6 million, $114.4 million and $98.3 million

for the years ended December 31, 2011, 2010 and 2009, respectively.

Acquired contracts include customer and contractual relationships and networks of subagents that are

recognized in connection with the Company’s acquisitions.

97