Western Union 2011 Annual Report Download - page 61

Download and view the complete annual report

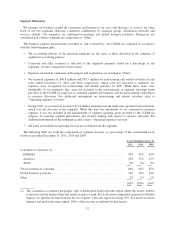

Please find page 61 of the 2011 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Foreign exchange revenues increased for the year ended December 31, 2010 over 2009 primarily due to

foreign exchange revenues contributed from our acquisition of Custom House. In addition to the impact of

Custom House, foreign exchange revenues in the consumer-to-consumer segment also grew, driven primarily by

revenue from the international business outside of the United States.

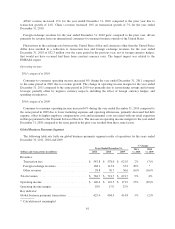

Fluctuations in the exchange rate between the United States dollar and currencies other than the United States

dollar have resulted in a reduction of transaction fee and foreign exchange revenue for the year ended

December 31, 2010 of $36.8 million over the previous year, net of foreign currency hedges, that would not have

occurred had there been constant currency rates. The largest impact was related to the EMEASA region.

Operating expenses overview

Restructuring and related activities

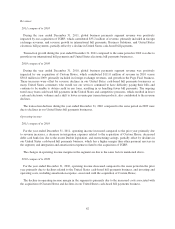

On May 25, 2010 and as subsequently revised, our Board of Directors approved a restructuring plan (the

“Restructuring Plan”) designed to reduce our overall headcount and migrate positions from various facilities,

primarily within North America and Europe, to regional operating centers. As of September 30, 2011, we had

incurred all of the expenses related to this Restructuring Plan. Total expense incurred under the Restructuring

Plan for the period from May 25, 2010 through December 31, 2011 was $106 million, consisting of $75 million

for severance and employee related benefits, $5 million for facility closures, including lease terminations, and

$26 million for other expenses. Included in these expenses are $2 million of non-cash expenses related to fixed

asset and leasehold improvement write-offs and accelerated depreciation at impacted facilities. Total cost savings

of approximately $55 million were generated in 2011. Cost savings of approximately $70 million are expected to

be generated in 2012 and annually thereafter.

For the years ended December 31, 2011 and 2010, restructuring and related expenses of $10.6 million and

$15.0 million, respectively, are classified within “Cost of services” and $36.2 million and $44.5 million,

respectively, are classified within “Selling, general and administrative” in the Consolidated Statements of

Income.

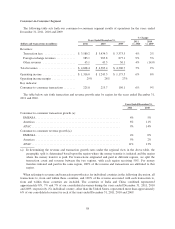

Cost of services

Cost of services increased for the year ended December 31, 2011 compared to the same period in 2010

primarily due to agent commissions, which increase in relation to revenue increases, the weakening of the United

States dollar compared to most other foreign currencies, which resulted in a negative impact on the translation of

our expenses, and incremental operating costs associated with TGBP, partially offset by commission savings

resulting from the acquisitions of Finint and Costa, and the lowering of certain other agent commission rates.

Cost of services as a percentage of revenue was 56% and 57% for the years ended December 31, 2011 and 2010,

respectively. The decrease in cost of services as a percentage of revenue was primarily due to commission

savings resulting from the acquisitions of Finint and Costa, offset by negative currency impacts.

Cost of services increased for the year ended December 31, 2010 compared to the same period in the prior year

primarily due to incremental costs, including those related to Custom House, our money order business and

advancing our electronic channel initiatives, including our web and account based money transfer services; agent

commissions, which primarily increase in relation to revenue increases; and restructuring and related expenses of

$15.0 million, offset by operating efficiencies, primarily decreased bad debt expense. Cost of services as a

percentage of revenue was 57% for both years ended December 31, 2010 and 2009 as incremental operating

costs, including costs associated with our money order business and advancing our electronic channel initiatives,

including our web and account based money transfer services, and restructuring and related expenses were offset

by operating efficiencies, primarily decreased bad debt expense.

54