Western Union 2011 Annual Report Download - page 123

Download and view the complete annual report

Please find page 123 of the 2011 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE WESTERN UNION COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

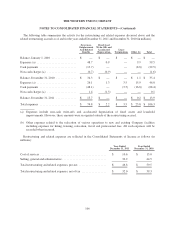

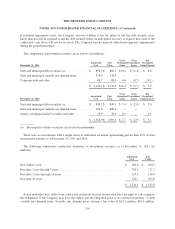

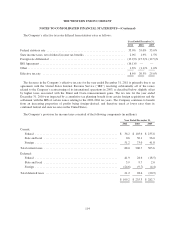

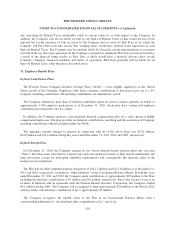

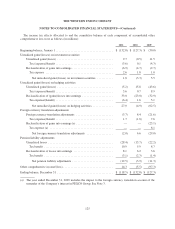

Unrecognized tax benefits represent the aggregate tax effect of differences between tax return positions and

the amounts otherwise recognized in the Company’s financial statements, and are reflected in “Income taxes

payable” in the Consolidated Balance Sheets. A reconciliation of the beginning and ending amount of

unrecognized tax benefits, excluding interest and penalties, is as follows (in millions):

2011 2010

Balance as of January 1, ...................................................... $ 618.7 $ 477.2

Increases—positions taken in current period (a) .................................... 143.1 134.1

Increases—positions taken in prior periods (b) .................................... 34.1 33.4

Increases—acquisitions ....................................................... 9.7 —

Decreases—positions taken in prior periods ....................................... (27.9) (21.8)

Decreases—settlements with taxing authorities .................................... (650.9) (0.8)

Decreases—lapse of applicable statute of limitations ................................ (3.1) (3.4)

Balance as of December 31, (c) ................................................ $ 123.7 $ 618.7

(a) Includes recurring accruals for issues which initially arose in previous periods.

(b) Changes to positions taken in prior periods relate to changes in estimates used to calculate prior period

unrecognized tax benefits.

(c) Balance at December 31, 2011, includes amounts related to a variety of U.S. federal and state and foreign

tax matters.

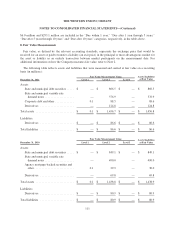

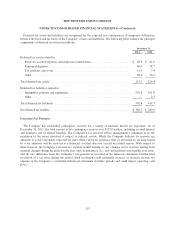

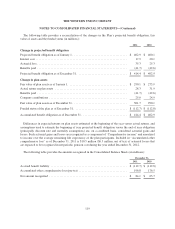

In December 2011, the Company reached an agreement with the IRS resolving substantially all of the issues

related to the Company’s restructuring of its international operations in 2003. As a result of the IRS Agreement,

the Company expects to make cash payments to the IRS and various state tax authorities in 2012 of

approximately $190 million, which are in addition to the $250 million tax deposit (see below) the Company

made with the IRS in 2010. This deposit limits the further accrual of interest charges with respect to the

Company’s related tax liabilities, to the extent of the deposit. Also as a result of the IRS Agreement, the

Company recorded a tax benefit of $204.7 million related to the adjustment of reserves associated with this

matter.

The total amount of unrecognized tax benefits that, if recognized, would affect the effective tax rate was

$115.6 million and $555.5 million as of December 31, 2011 and 2010, respectively, excluding interest and

penalties.

The Company recognizes interest and penalties with respect to unrecognized tax benefits in “Provision for

income taxes” in its Consolidated Statements of Income, and records the associated liability in “Income taxes

payable” in its Consolidated Balance Sheets. The Company recognized ($4.0) million, $6.9 million and

$11.0 million in interest and penalties during the years ended December 31, 2011, 2010 and 2009, respectively.

The Company has accrued $20.7 million and $52.4 million for the payment of interest and penalties as of

December 31, 2011 and 2010, respectively.

The Company has identified no uncertain tax positions for which it is reasonably possible that the total amount

of unrecognized tax benefits will significantly increase or decrease within 12 months. The change in

116