Western Union 2011 Annual Report Download - page 76

Download and view the complete annual report

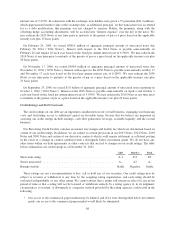

Please find page 76 of the 2011 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.• We may be required to pay a higher interest rate in future financings;

• Our potential pool of investors and funding sources may decrease;

• Regulators may impose additional capital and other requirements on us, including imposing restrictions on

the ability of our regulated subsidiaries to pay dividends; and

• Our business relationships may be adversely impacted.

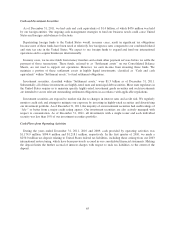

Consistent with the prior facility, the Revolving Credit Facility contains certain covenants that, among other

things, limit or restrict our ability to sell or transfer assets or enter into a merger or consolidate with another

company, grant certain types of security interests, incur certain types of liens, impose restrictions on subsidiary

dividends, enter into sale and leaseback transactions or incur certain subsidiary level indebtedness, subject to

certain exceptions. Our notes are subject to similar covenants except that only the 2016 Notes, 2020 Notes and

the 2036 Notes contain covenants limiting or restricting subsidiary indebtedness and none of our notes are

subject to a covenant that limits our ability to impose restrictions on subsidiary dividends. Also consistent with

the prior facility, the Revolving Credit Facility requires us to maintain a consolidated adjusted EBITDA interest

coverage ratio of greater than 2:1 (ratio of consolidated adjusted EBITDA, defined as net income plus the sum of

(a) interest expense, (b) income tax expense, (c) depreciation expense, (d) amortization expense, (e) any other

non-cash deductions, losses or changes made in determining net income for such period and (f) extraordinary

losses or charges, minus extraordinary gains, in each case determined in accordance with accounting principles

generally accepted in the United States of America for such period, to interest expense) for each period

comprising the four most recent consecutive fiscal quarters. Our consolidated interest coverage ratio was 9:1 for

the year ended December 31, 2011.

For the year ended December 31, 2011, we were in compliance with our debt covenants. A violation of our

debt covenants could impair our ability to borrow and outstanding amounts borrowed could become due, thereby

restricting our ability to use our excess cash for other purposes.

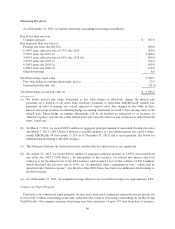

Cash Priorities

Liquidity

Our objective is to maintain strong liquidity and a capital structure consistent with our current credit ratings.

We have existing cash balances, cash flows from operating activities, access to the commercial paper markets

and our Revolving Credit Facility available to support the needs of our business.

Capital Expenditures

The total aggregate amount paid for contract costs, purchases of property and equipment and purchased and

developed software was $162.5 million, $113.7 million and $98.9 million in 2011, 2010 and 2009, respectively.

Amounts paid for new and renewed agent contracts vary depending on the terms of existing contracts as well as

the timing of new and renewed contract signings. Other capital expenditures during 2011, 2010 and 2009

included investments in our information technology infrastructure and purchased and developed software.

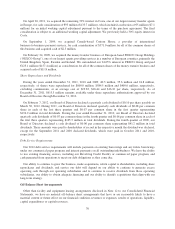

Acquisition of Businesses

On November 7, 2011, we acquired TGBP from Travelex Holdings Limited for cash consideration of

£603 million ($967.8 million), which included acquired cash of $40.0 million and an initial working capital

adjustment. The final consideration is subject to an additional working capital adjustment.

On October 31, 2011, we acquired the remaining 70% interest in Finint, one of our largest money transfer

agents in Europe, for cash consideration of €99.6 million ($139.4 million). We previously held a 30% equity

interest in Finint.

69