Western Union 2011 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2011 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE WESTERN UNION COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

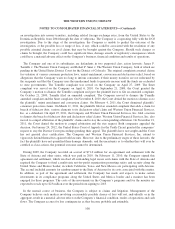

Prior to the acquisition, the Company held a 24.65% interest in FEXCO Group Holdings (“FEXCO Group”),

which was a holding company for both the money transfer business as well as various unrelated businesses. The

Company surrendered its 24.65% interest in FEXCO Group as non-cash consideration, which had an estimated

fair value of $86.2 million on the acquisition date, and paid €123.1 million ($157.4 million) as additional

consideration for all of the common shares of the money transfer business, resulting in a total purchase price of

$243.6 million. The Company recognized no gain or loss in connection with the disposition of its equity interest

in the FEXCO Group, because its estimated fair value approximated its carrying value. The Company recorded

the assets and liabilities of FEXCO at fair value, excluding the deferred tax liability. The valuation of assets

acquired resulted in $74.9 million of identifiable intangible assets, $64.8 million of which were attributable to the

network of subagents, with $10.1 million relating to other intangibles. The subagent network intangible assets are

being amortized over 10 to 15 years, and the remaining intangibles are being amortized over two to three years.

Goodwill of $190.6 million was recognized, of which $91.1 million is expected to be deductible for United States

income tax purposes.

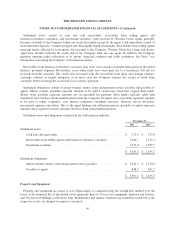

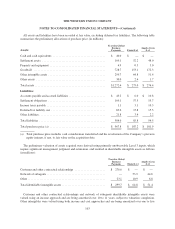

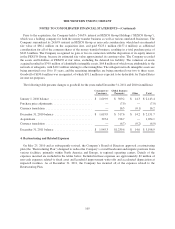

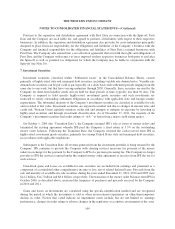

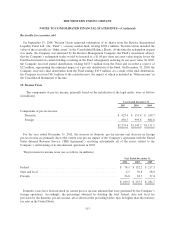

The following table presents changes to goodwill for the years ended December 31, 2011 and 2010 (in millions):

Consumer-to-

Consumer

Global Business

Payments Other Total

January 1, 2010 balance ............................ $ 1,619.9 $ 509.2 $ 14.3 $ 2,143.4

Purchase price adjustments .......................... — (7.9) — (7.9)

Currency translation ............................... — 16.3 (0.1) 16.2

December 31, 2010 balance ......................... $ 1,619.9 $ 517.6 $ 14.2 $ 2,151.7

Acquisitions ...................................... 325.4 728.7 — 1,054.1

Currency translation ............................... — (6.7) (0.2) (6.9)

December 31, 2011 balance ......................... $ 1,945.3 $1,239.6 $ 14.0 $ 3,198.9

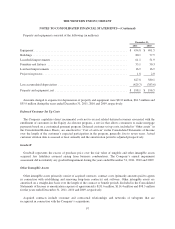

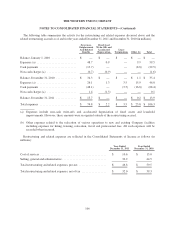

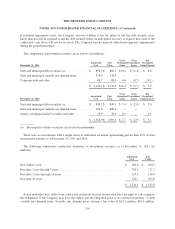

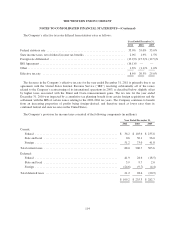

4. Restructuring and Related Expenses

On May 25, 2010 and as subsequently revised, the Company’s Board of Directors approved a restructuring

plan (the “Restructuring Plan”) designed to reduce the Company’s overall headcount and migrate positions from

various facilities, primarily within North America and Europe, to regional operating centers. Details of the

expenses incurred are included in the tables below. Included in these expenses are approximately $2 million of

non-cash expenses related to fixed asset and leasehold improvement write-offs and accelerated depreciation at

impacted facilities. As of December 31, 2011, the Company has incurred all of the expenses related to the

Restructuring Plan.

105