Western Union 2011 Annual Report Download - page 151

Download and view the complete annual report

Please find page 151 of the 2011 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

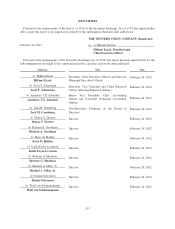

THE WESTERN UNION COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

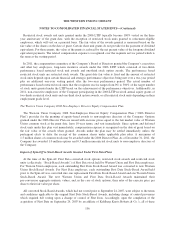

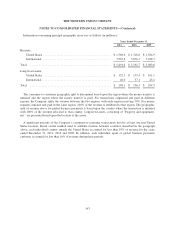

2012 Changes in Reportable Segments

In connection with the acquisition of TGBP, recent management changes, and other key strategic initiatives,

the Company will implement a new segment structure to assess performance and allocate resources, beginning in

the first quarter of 2012. The changes in the Company’s segment structure primarily relate to the separation of

the Global Business Payments segment into two new reportable segments, Consumer-to-Business and Business

Solutions. A summary of how the segments will be structured follows:

Segment Description

Consumer-to-Consumer Money transfer services between consumers, primarily through a global network

of third-party agents.

Consumer-to-Business Processing of payments from consumers to businesses and other organizations,

including utilities, auto finance companies, mortgage servicers, financial service

providers, government agencies and other businesses.

Business Solutions Business-to-business payment solutions, primarily for cross-border, cross-

currency transactions, including services provided under the Company’s existing

Western Union Business Solutions business and TGBP, which was acquired in

November 2011.

Other Businesses that have not been classified into one of the Company’s other

segments. These businesses primarily include the Company’s money order and

prepaid services businesses.

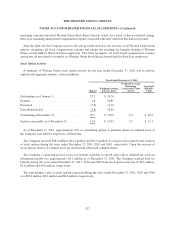

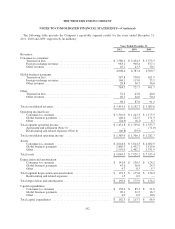

18. Quarterly Financial Information (Unaudited)

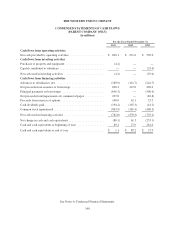

Summarized quarterly results for the years ended December 31, 2011 and 2010 were as follows (in millions,

except per share data):

2011 by Quarter: Q1 Q2 Q3 Q4

Year Ended

December 31,

2011

Revenues ................................ $ 1,283.0 $ 1,366.3 $ 1,410.8 $ 1,431.3 $ 5,491.4

Expenses (a) .............................. 970.1 1,015.6 1,047.8 1,072.9 4,106.4

Operating income .......................... 312.9 350.7 363.0 358.4 1,385.0

Other expense, net (b) ...................... 38.2 17.3 49.1 5.8 110.4

Income before income taxes ................. 274.7 333.4 313.9 352.6 1,274.6

Provision for/(benefit from) income taxes (c) .... 64.5 70.2 74.2 (99.7) 109.2

Net income ............................... $ 210.2 $ 263.2 $ 239.7 $ 452.3 $ 1,165.4

Earnings per share:

Basic ............................... $ 0.32 $ 0.42 $ 0.38 $ 0.73 $ 1.85

Diluted .............................. $ 0.32 $ 0.41 $ 0.38 $ 0.73 $ 1.84

Weighted-average shares outstanding:

Basic ............................... 646.9 631.1 624.9 619.4 630.6

Diluted .............................. 652.1 635.8 627.1 621.7 634.2

(a) Includes $24.0 million in the first quarter, $8.9 million in the second quarter and $13.9 million in the third

quarter of restructuring and related expenses. For more information, see Note 4.

144