Western Union 2011 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2011 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE WESTERN UNION COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

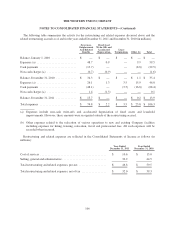

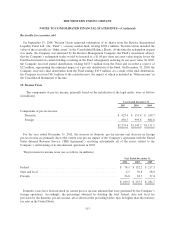

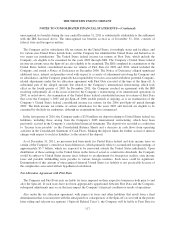

Pursuant to the separation and distribution agreement with First Data in connection with the Spin-off, First

Data and the Company are each liable for, and agreed to perform, all liabilities with respect to their respective

businesses. In addition, the separation and distribution agreement also provides for cross-indemnities principally

designed to place financial responsibility for the obligations and liabilities of the Company’s business with the

Company and financial responsibility for the obligations and liabilities of First Data’s retained businesses with

First Data. The Company also entered into a tax allocation agreement that sets forth the rights and obligations of

First Data and the Company with respect to taxes imposed on their respective businesses both prior to and after

the Spin-off as well as potential tax obligations for which the Company may be liable in conjunction with the

Spin-off (see Note 10).

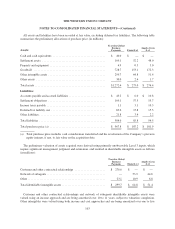

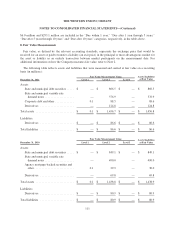

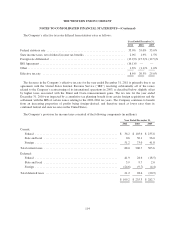

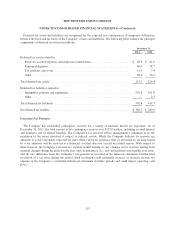

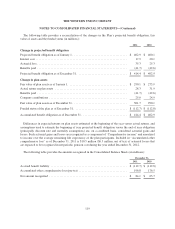

7. Investment Securities

Investment securities, classified within “Settlement assets” in the Consolidated Balance Sheets, consist

primarily of highly-rated state and municipal debt securities, including variable rate demand notes. Variable rate

demand note securities can be put (sold at par) typically on a daily basis with settlement periods ranging from the

same day to one week, but that have varying maturities through 2050. Generally, these securities are used by the

Company for short-term liquidity needs and are held for short periods of time, typically less than 30 days. The

Company is required to hold specific highly-rated, investment grade securities and such investments are

restricted to satisfy outstanding settlement obligations in accordance with applicable state and foreign country

requirements. The substantial majority of the Company’s investment securities are classified as available-for-sale

and recorded at fair value. Investment securities are exposed to market risk due to changes in interest rates and

credit risk. Western Union regularly monitors credit risk and attempts to mitigate its exposure by investing in

highly-rated securities and through investment diversification. As of December 31, 2011, the majority of the

Company’s investment securities had credit ratings of “AA–” or better from a major credit rating agency.

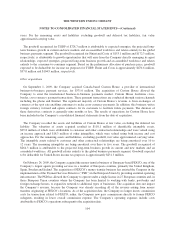

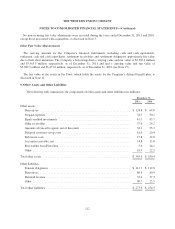

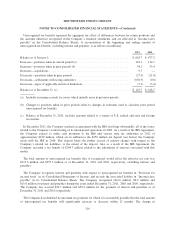

On October 1, 2009 (the “Transition Date”), the Company assumed IPS’s role as issuer of money orders and

terminated the existing agreement whereby IPS paid the Company a fixed return of 5.5% on the outstanding

money order balances. Following the Transition Date, the Company invested the cash received from IPS in

highly-rated, investment grade securities, primarily tax exempt United States state and municipal debt securities,

in accordance with applicable regulations.

Subsequent to the Transition Date, all revenue generated from the investment portfolio is being retained by the

Company. IPS continues to provide the Company with clearing services necessary for payment of the money

orders in exchange for the payment by the Company to IPS of a per-item processing fee. The Company no longer

provides to IPS the services required under the original money order agreement or receives from IPS the fee for

such services.

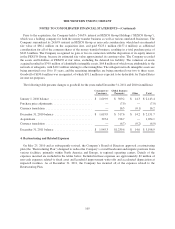

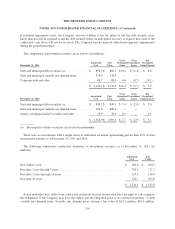

Unrealized gains and losses on available-for-sale securities are excluded from earnings and presented as a

component of accumulated other comprehensive income or loss, net of related deferred taxes. Proceeds from the

sale and maturity of available-for-sale securities during the years ended December 31, 2011, 2010 and 2009 were

$14.2 billion, $14.7 billion and $8.4 billion, respectively. The transition of the money order business from IPS in

October 2009, as described above, increased the frequency of purchases and proceeds received by the Company

in 2010 and 2011.

Gains and losses on investments are calculated using the specific-identification method and are recognized

during the period in which the investment is sold or when an investment experiences an other-than-temporary

decline in value. Factors that could indicate an impairment exists include, but are not limited to: earnings

performance, changes in credit rating or adverse changes in the regulatory or economic environment of the asset.

109