Western Union 2011 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2011 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE WESTERN UNION COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

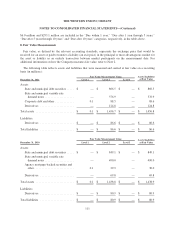

Receivable for securities sold

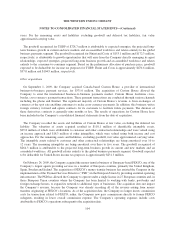

On September 15, 2008, Western Union requested redemption of its shares from the Reserve International

Liquidity Fund, Ltd. (the “Fund”), a money market fund, totaling $298.1 million. Western Union included the

value of the receivable in “Other assets” in the Consolidated Balance Sheets. At the time the redemption request

was made, the Company was informed by the Reserve Management Company, the Fund’s investment advisor,

that the Company’s redemption trades would be honored at a $1.00 per share net asset value despite losses the

Fund had incurred on certain holdings resulting in the Fund subsequently reducing its net asset value. In 2009,

the Company received partial distributions totaling $255.5 million from the Fund and recorded a reserve of

$12 million, representing the estimated impact of a pro-rata distribution of the Fund. On December 31, 2010, the

Company received a final distribution from the Fund totaling $36.9 million. As a result of the final distribution,

the Company recovered $6.3 million of the related reserve, the impact of which is included in “Other income” in

the Consolidated Statements of Income.

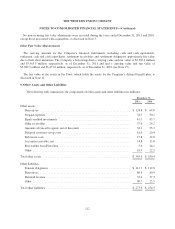

10. Income Taxes

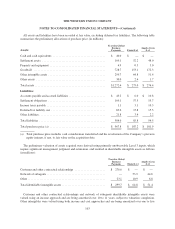

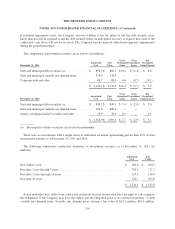

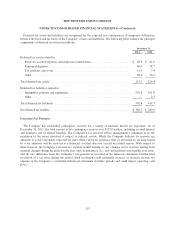

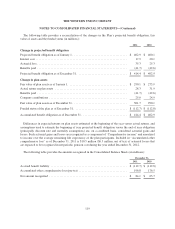

The components of pre-tax income, generally based on the jurisdiction of the legal entity, were as follows

(in millions):

Year Ended December 31,

2011 2010 2009

Components of pre-tax income:

Domestic ..................................................... $ 423.9 $ 151.4 $ 249.7

Foreign ...................................................... 850.7 993.8 881.8

$1,274.6 $1,145.2 $1,131.5

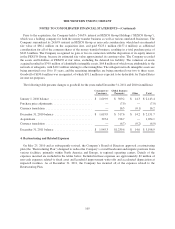

For the year ended December 31, 2011, the increase in domestic pre-tax income and decrease in foreign

pre-tax income are primarily due to the current year pre-tax impact of the Company’s agreement with the United

States Internal Revenue Service (“IRS Agreement”) resolving substantially all of the issues related to the

Company’s restructuring of its international operations in 2003.

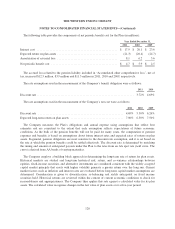

The provision for income taxes was as follows (in millions):

Year Ended December 31,

2011 2010 2009

Federal ........................................................... $ 78.1 $ 132.2 $ 217.3

State and local ..................................................... 4.5 39.8 28.0

Foreign ........................................................... 26.6 63.3 37.4

$ 109.2 $ 235.3 $ 282.7

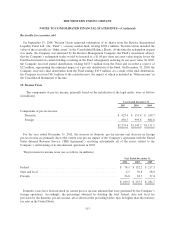

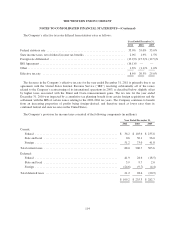

Domestic taxes have been incurred on certain pre-tax income amounts that were generated by the Company’s

foreign operations. Accordingly, the percentage obtained by dividing the total federal, state and local tax

provision by the domestic pre-tax income, all as shown in the preceding tables, may be higher than the statutory

tax rates in the United States.

113