Western Union 2011 Annual Report Download - page 129

Download and view the complete annual report

Please find page 129 of the 2011 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE WESTERN UNION COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

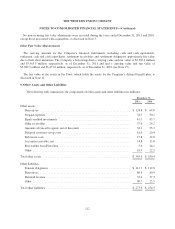

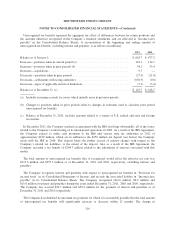

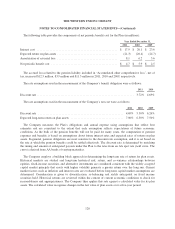

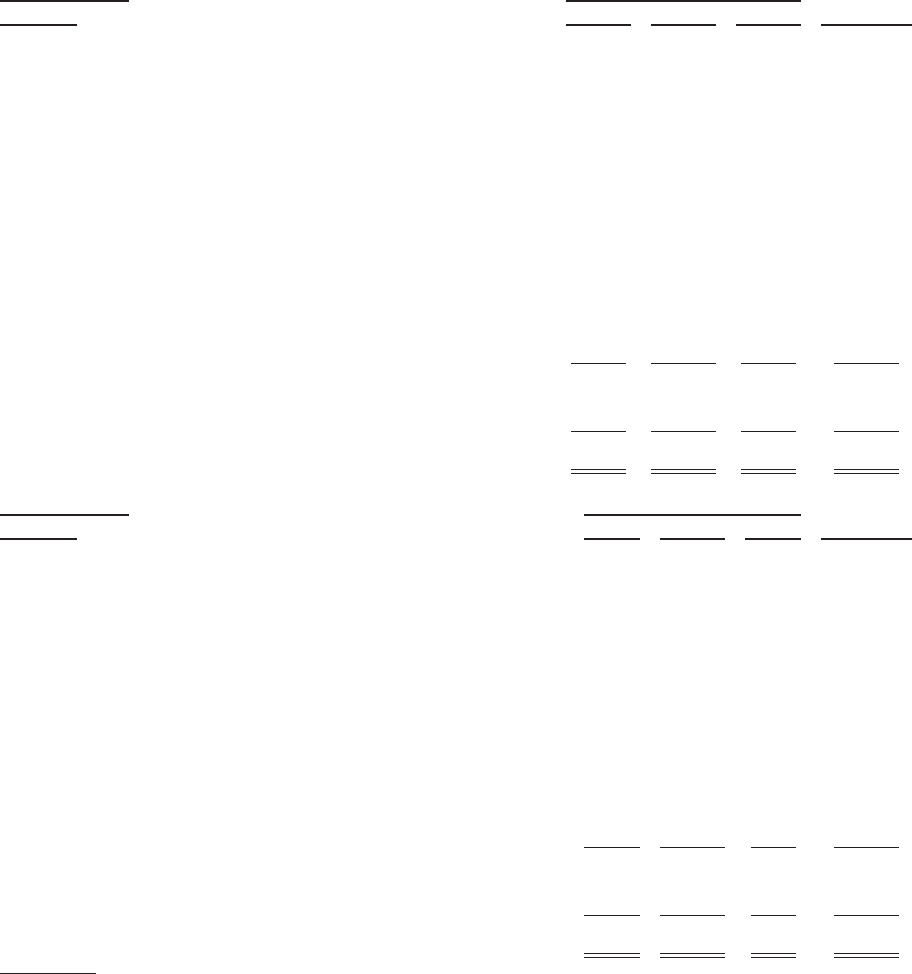

The following tables reflect investments of the Trust that were measured and carried at fair value (in millions).

For information on how the Company measures fair value, refer to Note 2.

December 31, 2011 Fair Value Measurement Using Total Assets

at Fair ValueAsset Class Level 1 Level 2 Level 3

Equity investments

Domestic .......................................... $ 28.1 $ — $ — $ 28.1

International ........................................ — 22.4 — 22.4

Debt securities

Corporate debt (a) ................................... — 134.1 — 134.1

U.S. treasury bonds .................................. 39.8 — — 39.8

U.S. government agencies ............................. — 4.7 — 4.7

Other ............................................. — 3.0 — 3.0

Alternative investments

Hedge funds (b) ..................................... — 52.8 — 52.8

Royalty rights and private equity (c) ..................... — — 13.6 13.6

Total investments of the Trust at fair value .................... $ 67.9 $ 217.0 $ 13.6 $ 298.5

Other assets ............................................ 3.2

Total investments of the Trust .............................. $ 67.9 $ 217.0 $ 13.6 $ 301.7

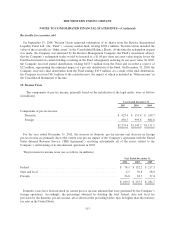

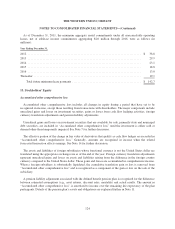

December 31, 2010 Fair Value Measurement Using Total Assets

at Fair ValueAsset Class Level 1 Level 2 Level 3

Equity investments

Domestic ............................................ $ 3.1 $ 40.9 $ — $ 44.0

International .......................................... — 45.2 — 45.2

Private equity ......................................... — — 1.3 1.3

Debt securities

Corporate debt (a) ..................................... — 117.3 — 117.3

U.S. treasury bonds .................................... 57.9 — — 57.9

U.S. government agencies ............................... — 6.8 — 6.8

Asset-backed ......................................... — 6.0 — 6.0

Other bonds .......................................... — 9.0 — 9.0

Total investments of the Trust at fair value ...................... $ 61.0 $ 225.2 $ 1.3 $ 287.5

Other assets .............................................. 2.6

Total investments of the Trust ................................ $ 61.0 $ 225.2 $ 1.3 $ 290.1

(a) Substantially all corporate debt securities are investment grade securities.

(b) Hedge funds generally hold liquid and readily priceable securities, such as public equities, exchange-traded

derivatives, and corporate bonds. Hedge funds themselves do not have readily available market quotations,

122