Western Union 2011 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2011 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE WESTERN UNION COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

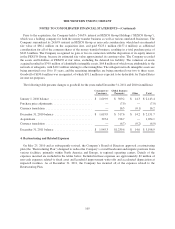

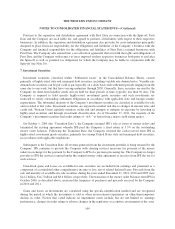

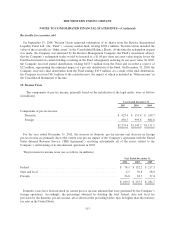

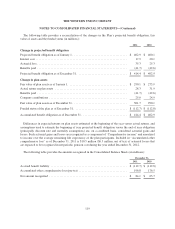

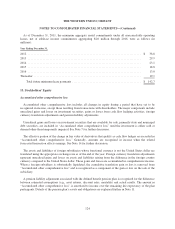

Deferred tax assets and liabilities are recognized for the expected tax consequences of temporary differences

between the book and tax bases of the Company’s assets and liabilities. The following table outlines the principal

components of deferred tax items (in millions):

December 31,

2011 2010

Deferred tax assets related to:

Reserves, accrued expenses and employee-related items .......................... $ 40.6 $ 61.6

Pension obligations ....................................................... 40.0 38.7

Tax attribute carryovers ................................................... 11.9 7.4

Other .................................................................. 20.6 16.7

Total deferred tax assets ...................................................... 113.1 124.4

Deferred tax liabilities related to:

Intangibles, property and equipment .......................................... 502.8 411.8

Other .................................................................. — 2.5

Total deferred tax liabilities ................................................... 502.8 414.3

Net deferred tax liability ...................................................... $ 389.7 $ 289.9

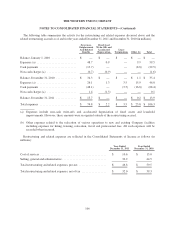

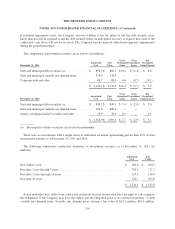

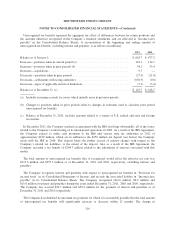

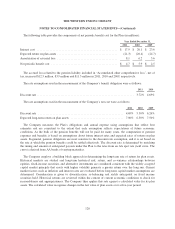

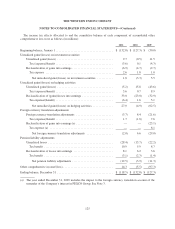

Uncertain Tax Positions

The Company has established contingency reserves for a variety of material, known tax exposures. As of

December 31, 2011, the total amount of tax contingency reserves was $135.0 million, including accrued interest

and penalties, net of related benefits. The Company’s tax reserves reflect management’s judgment as to the

resolution of the issues involved if subject to judicial review. While the Company believes its reserves are

adequate to cover reasonably expected tax risks, there can be no assurance that, in all instances, an issue raised

by a tax authority will be resolved at a financial cost that does not exceed its related reserve. With respect to

these reserves, the Company’s income tax expense would include (i) any changes in tax reserves arising from

material changes during the period in the facts and circumstances (i.e., new information) surrounding a tax issue,

and (ii) any difference from the Company’s tax position as recorded in the financial statements and the final

resolution of a tax issue during the period. Such resolution could materially increase or decrease income tax

expense in the Company’s consolidated financial statements in future periods and could impact operating cash

flows.

115