Western Union 2011 Annual Report Download - page 132

Download and view the complete annual report

Please find page 132 of the 2011 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE WESTERN UNION COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

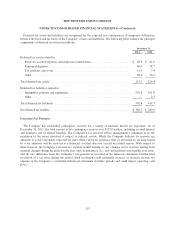

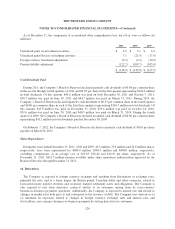

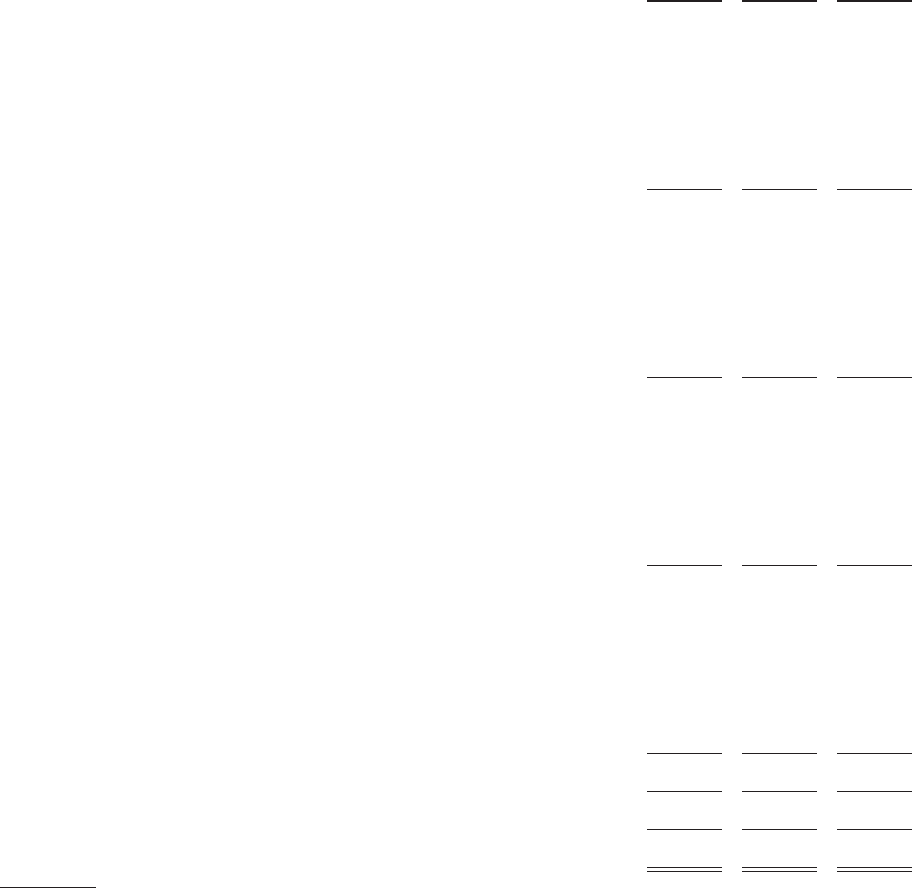

The income tax effects allocated to and the cumulative balance of each component of accumulated other

comprehensive loss were as follows (in millions):

2011 2010 2009

Beginning balance, January 1 ....................................... $ (132.8) $ (127.3) $ (30.0)

Unrealized gains/(losses) on investment securities:

Unrealized gains/(losses) ...................................... 9.7 (0.5) 11.5

Tax (expense)/benefit ....................................... (3.6) 0.1 (4.3)

Reclassification of gains into earnings ............................ (6.9) (4.7) (2.7)

Tax expense .............................................. 2.6 1.8 1.0

Net unrealized gains/(losses) on investment securities ........... 1.8 (3.3) 5.5

Unrealized gains/(losses) on hedging activities:

Unrealized gains/(losses) ...................................... (5.2) 15.8 (43.6)

Tax (expense)/benefit ....................................... 5.6 0.7 8.9

Reclassification of (gains)/losses into earnings ..................... 33.0 (23.0) (32.9)

Tax expense/(benefit) ....................................... (6.4) 1.6 5.1

Net unrealized gains/(losses) on hedging activities .............. 27.0 (4.9) (62.5)

Foreign currency translation adjustments:

Foreign currency translation adjustments ......................... (3.7) 8.4 (21.6)

Tax (expense)/benefit ....................................... 1.7 (1.8) 7.6

Reclassification of gains into earnings (a) ......................... — — (23.1)

Tax expense (a) ........................................... — — 8.1

Net foreign currency translation adjustments .................. (2.0) 6.6 (29.0)

Pension liability adjustments:

Unrealized losses ............................................ (28.4) (13.7) (22.2)

Tax benefit ............................................... 10.9 5.9 8.7

Reclassification of losses into earnings ........................... 8.1 6.2 3.6

Tax benefit ............................................... (3.1) (2.3) (1.4)

Net pension liability adjustments ............................ (12.5) (3.9) (11.3)

Other comprehensive income/(loss) .................................. 14.3 (5.5) (97.3)

Ending balance, December 31 ...................................... $ (118.5) $ (132.8) $ (127.3)

(a) The year ended December 31, 2009 includes the impact to the foreign currency translation account of the

surrender of the Company’s interest in FEXCO Group. See Note 3.

125