Western Union 2011 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2011 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE WESTERN UNION COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

an investigation into money transfers, including related foreign exchange rates, from the United States to the

Dominican Republic from 2004 through the date of subpoena. The Company is cooperating fully with the DOJ

investigation. Due to the stage of the investigation, the Company is unable to predict the outcome of the

investigation, or the possible loss or range of loss, if any, which could be associated with the resolution of any

possible criminal charges or civil claims that may be brought against the Company. Should such charges or

claims be brought, the Company could face significant fines, damage awards or regulatory consequences which

could have a material adverse effect on the Company’s business, financial condition and results of operations.

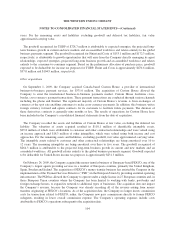

The Company and one of its subsidiaries are defendants in two purported class action lawsuits: James P.

Tennille v. The Western Union Company and Robert P. Smet v. The Western Union Company, both of which are

pending in the United States District Court for the District of Colorado. The original complaints asserted claims

for violation of various consumer protection laws, unjust enrichment, conversion and declaratory relief, based on

allegations that the Company waits too long to inform consumers if their money transfers are not redeemed by

the recipients and that the Company uses the unredeemed funds to generate income until the funds are escheated

to state governments. The Tennille complaint was served on the Company on April 27, 2009. The Smet

complaint was served on the Company on April 6, 2010. On September 21, 2009, the Court granted the

Company’s motion to dismiss the Tennille complaint and gave the plaintiff leave to file an amended complaint.

On October 21, 2009, Tennille filed an amended complaint. The Company moved to dismiss the Tennille

amended complaint and the Smet complaint. On November 8, 2010, the Court denied the motion to dismiss as to

the plaintiffs’ unjust enrichment and conversion claims. On February 4, 2011, the Court dismissed plaintiffs’

consumer protection claims. On March 11, 2011, the plaintiffs filed an amended complaint that adds a claim for

breach of fiduciary duty, various elements to its declaratory relief claim and Western Union Financial Services,

Inc. as a defendant. On April 25, 2011, the Company and Western Union Financial Services, Inc. filed a motion

to dismiss the breach of fiduciary duty and declaratory relief claims. Western Union Financial Services, Inc. also

moved to compel arbitration of the plaintiffs’ claims and to stay the action pending arbitration. On November 21,

2011, the Court denied the motion to compel arbitration and the stay request. Both companies appealed the

decision. On January 24, 2012, the United States Court of Appeals for the Tenth Circuit granted the companies’

request to stay the District Court proceedings pending their appeal. The plaintiffs have not sought and the Court

has not granted class certification. The Company and Western Union Financial Services, Inc. intend to

vigorously defend themselves against both lawsuits. However, due to the preliminary stages of these lawsuits, the

fact the plaintiffs have not quantified their damage demands, and the uncertainty as to whether they will ever be

certified as class actions, the potential outcome cannot be determined.

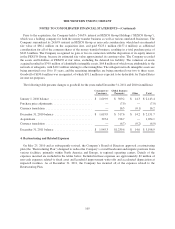

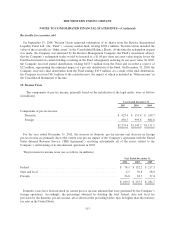

During 2009, the Company recorded an accrual of $71.0 million for an agreement and settlement with the

State of Arizona and other states, which was paid in 2010. On February 11, 2010, the Company signed this

agreement and settlement, which resolved all outstanding legal issues and claims with the State of Arizona and

required the Company to fund a multi-state not-for-profit organization promoting safety and security along the

United States and Mexico border, in which California, Texas and New Mexico are participating with Arizona.

The accrual included amounts for reimbursement to the State of Arizona for its costs associated with this matter.

In addition, as part of the agreement and settlement, the Company has made and expects to make certain

investments in its compliance programs along the United States and Mexico border and a monitor has been

engaged for those programs. The costs of the investments in the Company’s programs and for the monitor are

expected to reach up to $23 million over the period from signing to 2013.

In the normal course of business, the Company is subject to claims and litigation. Management of the

Company believes such matters involving a reasonably possible chance of loss will not, individually or in the

aggregate, result in a material adverse effect on the Company’s financial condition, results of operations and cash

flows. The Company accrues for loss contingencies as they become probable and estimable.

108