Western Union 2011 Annual Report Download - page 128

Download and view the complete annual report

Please find page 128 of the 2011 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE WESTERN UNION COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

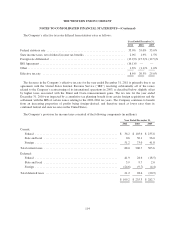

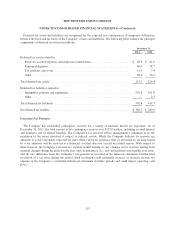

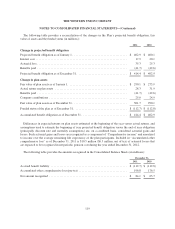

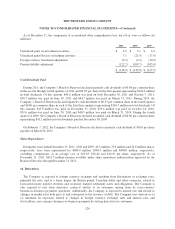

Pension plan asset allocation as of December 31, 2011 and 2010, and target allocations based on investment

policies, were as follows:

Percentage of Plan Assets

as of Measurement Date

Asset Class 2011 2010

Equity investments ........................................................ 17% 31%

Debt securities ........................................................... 61% 69%

Alternative investments .................................................... 22% 0%

100% 100%

Target Allocation

Equity investments ............................................................. 15%

Debt securities ................................................................. 60%

Alternative investments .......................................................... 25%

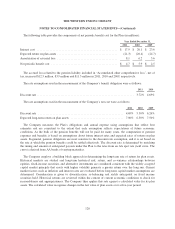

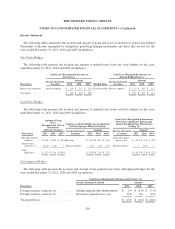

The assets of the Company’s Plan are managed in a third-party Trust. The investment policy and allocation of

the assets in the Trust are overseen by the Company’s Investment Council. The Company employs a total return

investment approach whereby a mix of equity, fixed income, and alternative investments are used in an effort to

maximize the long-term return of plan assets. Risk tolerance is established through careful consideration of plan

liabilities and plan funded status. The investment portfolio contains a diversified blend of equity, fixed-income,

and alternative investments (e.g. hedge funds, royalty rights and private equity funds). Furthermore, equity

investments are diversified across United States and non-United States stocks, as well as securities deemed to be

growth, value, and small and large capitalizations. Alternative investments, the significant majority of which are

hedge funds, are used in an effort to enhance long-term returns while improving portfolio diversification. Hedge

fund strategy types include, but are not limited to: commodities/currencies, equity long-short, relative value,

multi-strategy, event driven, and global-macro. The Plan holds derivative contracts directly which consist of

standardized obligations to buy or sell United States treasury bonds or notes at predetermined future dates and

prices which are transacted on regulated exchanges. Additionally, derivatives are held indirectly through funds in

which the Plan is invested. Derivatives are used by the Plan to help reduce the Plan’s exposure to interest rate

volatility and to provide an additional source of return. Cash held by the Plan is used to satisfy margin

requirements on the derivatives. Investment risk is measured and monitored on an ongoing basis through

quarterly investment portfolio reviews, annual liability measurements, and periodic asset and liability studies.

121