Western Union 2011 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2011 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

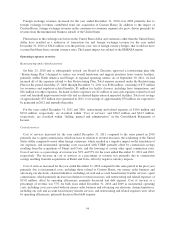

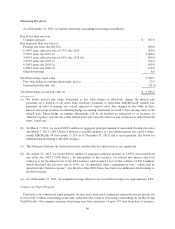

2012 Changes in Reportable Segments

In connection with the acquisition of TGBP, recent management changes, and other key strategic initiatives,

we will implement a new segment structure to assess performance and allocate resources, beginning in the first

quarter of 2012. The changes in our segment structure primarily relate to the separation of the Global Business

Payments segment into two new reportable segments, Consumer-to-Business and Business Solutions. A

summary of how the segments will be structured follows:

Segment Description

Consumer-to-Consumer Money transfer services between consumers, primarily through a global network of

third-party agents.

Consumer-to-Business Processing of payments from consumers to businesses and other organizations,

including utilities, auto finance companies, mortgage servicers, financial service

providers, government agencies and other businesses.

Business Solutions Business-to-business payment solutions, primarily for cross-border, cross-currency

transactions, including services provided under our existing Western Union Business

Solutions business and TGBP, which was acquired in November 2011.

Other Businesses that have not been classified into one of our other segments. These

businesses primarily include our money order and prepaid services businesses.

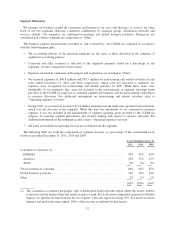

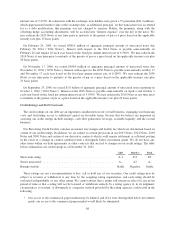

Capital Resources and Liquidity

Our primary source of liquidity has been cash generated from our operating activities, primarily from net

income and fluctuations in working capital. Our working capital is affected by the timing of interest payments on

our outstanding borrowings, timing of income tax payments, including our tax deposit described further in “Cash

Flows from Operating Activities,” and collections on receivables, among other items. The majority of our interest

payments are due in the second and fourth quarters which results in a decrease in the amount of cash provided by

operating activities in those quarters and a corresponding increase to the first and third quarters.

Our future cash flows could be impacted by a variety of factors, some of which are out of our control,

including changes in economic conditions, especially those impacting the migrant population and changes in

income tax laws or the status of income tax audits, including the resolution of outstanding tax matters.

A significant portion of our cash flows from operating activities has been generated from subsidiaries, some of

which are regulated entities. These subsidiaries may transfer all excess cash to the parent company for general

corporate use except for assets subject to legal or regulatory restrictions. Assets subject to legal or regulatory

restrictions, totaling approximately $230 million as of December 31, 2011, include assets outside of the United

States subject to restrictions from being transferred outside of the countries where they are located. We are also

required to maintain cash and investment balances in our regulated subsidiaries related to certain of our money

transfer and other payment obligations. Significant changes in the regulatory environment for money transmitters

could impact our primary source of liquidity.

We believe we have adequate liquidity to meet our business needs, including approximately $190 million of

tax payments we expect to make in 2012 as a result of the IRS Agreement, dividends and share repurchases,

through our existing cash balances and our ability to generate cash flows through operations. As of December 31,

2011, we had no outstanding borrowings under our $1.65 billion revolving credit facility (“Revolving Credit

Facility”) and had $297.0 million of commercial paper borrowings outstanding, which left $1,353.0 million

remaining that was available to borrow on the Revolving Credit Facility.

64