Western Union 2011 Annual Report Download - page 52

Download and view the complete annual report

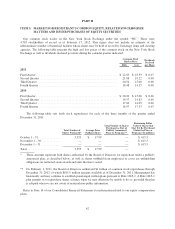

Please find page 52 of the 2011 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.(b) Our stock-based compensation expense in 2007 included a charge of $22.3 million related to the vesting of the

remaining converted unvested Western Union stock-based awards upon the completion of the acquisition of

First Data Corporation on September 24, 2007 by an affiliate of Kohlberg Kravis Roberts & Co.

(c) Operating expenses for the years ended December 31, 2011 and 2010 included $46.8 million and

$59.5 million of restructuring and related expenses, respectively, associated with a restructuring plan

designed to reduce overall headcount and migrate positions from various facilities, primarily within the

United States and Europe, to regional operating centers. Operating expenses for the year ended

December 31, 2008 included $82.9 million of restructuring and related expenses associated with the closure

of our facilities in Missouri and Texas and other reorganization plans. No restructuring and related expenses

were incurred during 2009 or 2007.

(d) Operating expenses for the year ended December 31, 2009 included an accrual of $71.0 million resulting

from an agreement and settlement, which resolved all outstanding legal issues and claims with the State of

Arizona and required us to fund a multi-state not-for-profit organization promoting safety and security along

the United States and Mexico border, in which California, Texas and New Mexico have participated with

Arizona. The settlement agreement was signed on February 11, 2010.

(e) Interest income consists of interest earned on cash balances not required to satisfy settlement obligations

and in connection with loans previously made to certain existing agents.

(f) Interest expense primarily relates to our outstanding borrowings.

(g) In 2011, we recognized gains of $20.5 million and $29.4 million, in connection with the remeasurement of

our former equity interests in Finint, S.r.l. and Angelo Costa, S.r.l., respectively, to fair value. These equity

interests were remeasured in conjunction with our purchases of the remaining interests in these entities that

we previously did not hold. Additionally, in 2011, we recognized a $20.8 million net gain on foreign

currency forward contracts with maturities of less than one year entered into in order to reduce the economic

variability related to the cash amounts used to fund acquisitions of businesses with purchase prices

denominated in foreign currencies, primarily for the TGBP acquisition. In 2009, given the increased

uncertainty, at that time, surrounding the numerous third-party legal claims associated with our receivable

from the Reserve International Liquidity Fund, Ltd., we reserved $12.0 million representing the estimated

impact of a pro-rata distribution. In 2010, we recorded a recovery of this reserve of $6.3 million due to the

final settlement of this receivable.

(h) In December 2011, we reached an agreement with the United States Internal Revenue Service (“IRS

Agreement”) resolving substantially all of the issues related to the restructuring of our international

operations in 2003. As a result of the IRS Agreement, we recognized a tax benefit of $204.7 million related

to the adjustment of reserves associated with this matter.

(i) Net cash provided by operating activities decreased during the year ended December 31, 2010, primarily

due to a $250 million tax deposit made relating to United States federal tax liabilities, including those

arising from our 2003 international restructuring, which were previously accrued in our consolidated

financial statements. Also impacting net cash provided by operating activities during the year ended

December 31, 2010 were cash payments of $71.0 million related to the agreement and settlement with the

State of Arizona and other states.

(j) Capital expenditures include capitalization of contract costs, capitalization of purchased and developed

software and purchases of property and equipment.

(k) On February 1, 2011, the Board of Directors authorized $1 billion of common stock repurchases through

December 31, 2012, of which $615.5 million remains available as of December 31, 2011. During the years

ended December 31, 2011, 2010, 2009, 2008 and 2007, we repurchased 40.3 million, 35.6 million,

24.8 million, 58.1 million and 34.7 million shares, respectively.

45