Western Union 2011 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2011 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

interest rate of 5.253%. In connection with the exchange, note holders were given a 7% premium ($21.2 million),

which approximated market value at the exchange date, as additional principal. As this transaction was accounted

for as a debt modification, this premium was not charged to expense. Rather, the premium, along with the

offsetting hedge accounting adjustments, will be accreted into “Interest expense” over the life of the notes. We

may redeem the 2020 Notes at any time prior to maturity at the greater of par or a price based on the applicable

treasury rate plus 15 basis points.

On February 26, 2009, we issued $500.0 million of aggregate principal amount of unsecured notes due

February 26, 2014 (“2014 Notes”). Interest with respect to the 2014 Notes is payable semi-annually on

February 26 and August 26 each year based on the fixed per annum interest rate of 6.500%. We may redeem the

2014 Notes at any time prior to maturity at the greater of par or a price based on the applicable treasury rate plus

50 basis points.

On November 17, 2006, we issued $500.0 million of aggregate principal amount of unsecured notes due

November 17, 2036 (“2036 Notes”). Interest with respect to the 2036 Notes is payable semi-annually on May 17

and November 17 each year based on the fixed per annum interest rate of 6.200%. We may redeem the 2036

Notes at any time prior to maturity at the greater of par or a price based on the applicable treasury rate plus

25 basis points.

On September 29, 2006, we issued $1.0 billion of aggregate principal amount of unsecured notes maturing on

October 1, 2016 (“2016 Notes”). Interest on the 2016 Notes is payable semi-annually on April 1 and October 1

each year based on the fixed per annum interest rate of 5.930%. We may redeem the 2016 Notes at any time prior

to maturity at the greater of par or a price based on the applicable treasury rate plus 20 basis points.

Credit Ratings and Debt Covenants

The credit ratings on our debt are an important consideration in our overall business, managing our financing

costs and facilitating access to additional capital on favorable terms. Factors that we believe are important in

assessing our credit ratings include earnings, cash flow generation, leverage, available liquidity and the overall

business.

Our Revolving Credit Facility contains an interest rate margin and facility fee which are determined based on

certain of our credit ratings. In addition, we are subject to certain provisions in our 2013 Notes, 2014 Notes, 2018

Notes and 2040 Notes and certain of our derivative contracts which could require settlement or collateral posting

in the event of a change in control combined with a downgrade below investment grade. We do not have any

other terms within our debt agreements or other contracts that are tied to changes in our credit ratings. The table

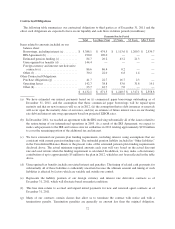

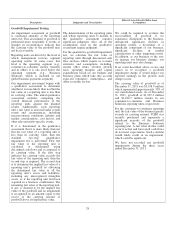

below summarizes our credit ratings as of December 31, 2011:

S&P Moody’s Fitch

Short-term rating ................................................. A-2 P-2 F2

Senior unsecured ................................................. A– A3 A–

Ratings outlook .................................................. Stable Negative Stable

These ratings are not a recommendation to buy, sell or hold any of our securities. Our credit ratings may be

subject to revision or withdrawal at any time by the assigning rating organization, and each rating should be

evaluated independently of any other rating. We cannot ensure that a rating will remain in effect for any given

period of time or that a rating will not be lowered or withdrawn entirely by a rating agency if, in its judgment,

circumstances so warrant. A downgrade or a negative outlook provided by the rating agencies could result in the

following:

• Our access to the commercial paper market may be limited, and if we were downgraded below investment

grade, our access to the commercial paper market would likely be eliminated;

68