Western Union 2011 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2011 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

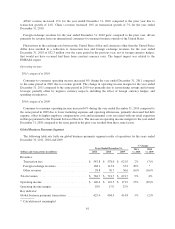

APAC revenue increased 13% for the year ended December 31, 2010 compared to the prior year due to

transaction growth of 14%. China’s revenue increased 10% on transaction growth of 7% for the year ended

December 31, 2010.

Foreign exchange revenues for the year ended December 31, 2010 grew compared to the prior year, driven

primarily by revenue from our international consumer-to-consumer business outside of the United States.

Fluctuations in the exchange rate between the United States dollar and currencies other than the United States

dollar have resulted in a reduction to transaction fees and foreign exchange revenues for the year ended

December 31, 2010 of $32.3 million over the same period in the previous year, net of foreign currency hedges,

that would not have occurred had there been constant currency rates. The largest impact was related to the

EMEASA region.

Operating income

2011 compared to 2010

Consumer-to-consumer operating income increased 6% during the year ended December 31, 2011 compared

to the same period in 2010 due to revenue growth. The change in operating income margin for the year ended

December 31, 2011 compared to the same period in 2010 was primarily due to restructuring savings and revenue

leverage, partially offset by negative currency impacts, including the effect of foreign currency hedges, and

spending on initiatives.

2010 compared to 2009

Consumer-to-consumer operating income increased 6% during the year ended December 31, 2010 compared to

the same period in 2009 due to lower marketing expenses and operating efficiencies, primarily decreased bad debt

expense, offset by higher employee compensation costs and incremental costs associated with our retail expansion

in Europe pursuant to the Payment Services Directive. The increase in operating income margin for the year ended

December 31, 2010 compared to the same period in the prior year resulted from these same factors.

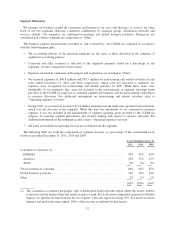

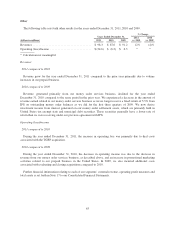

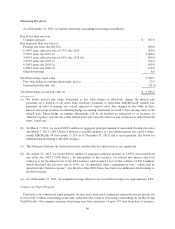

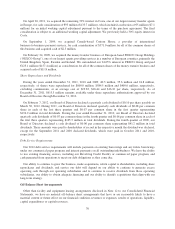

Global Business Payments Segment

The following table sets forth our global business payments segment results of operations for the years ended

December 31, 2011, 2010 and 2009.

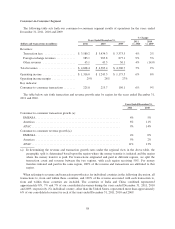

Years Ended December 31,

% Change

2011

vs. 2010

2010

vs. 2009(dollars and transactions in millions) 2011 2010 2009

Revenues:

Transaction fees ............................. $ 587.8 $ 578.0 $ 621.9 2% (7)%

Foreign exchange revenues .................... 168.1 113.0 33.2 49% *

Other revenues .............................. 28.8 30.7 36.6 (6)% (16)%

Total revenues ................................ $ 784.7 $ 721.7 $ 691.7 9% 4%

Operating income .............................. $ 140.4 $ 122.5 $ 171.9 15% (29)%

Operating income margin ........................ 18% 17% 25%

Key indicator:

Global business payments transactions ............. 425.0 404.9 414.8 5% (2)%

* Calculation not meaningful

61