Western Union 2011 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2011 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Cash and Investment Securities

As of December 31, 2011, we had cash and cash equivalents of $1.4 billion, of which $476 million was held

by our foreign entities. Our ongoing cash management strategies to fund our business needs could cause United

States and foreign cash balances to fluctuate.

Repatriating foreign funds to the United States would, in many cases, result in significant tax obligations

because most of these funds have been taxed at relatively low foreign tax rates compared to our combined federal

and state tax rate in the United States. We expect to use foreign funds to expand and fund our international

operations and to acquire businesses internationally.

In many cases, we receive funds from money transfers and certain other payment services before we settle the

payment of those transactions. These funds, referred to as “Settlement assets” on our Consolidated Balance

Sheets, are not used to support our operations. However, we earn income from investing these funds. We

maintain a portion of these settlement assets in highly liquid investments, classified as “Cash and cash

equivalents” within “Settlement assets,” to fund settlement obligations.

Investment securities, classified within “Settlement assets,” were $1.3 billion as of December 31, 2011.

Substantially all of these investments are highly-rated state and municipal debt securities. Most state regulators in

the United States require us to maintain specific highly-rated, investment grade securities and such investments

are intended to secure relevant outstanding settlement obligations in accordance with applicable regulations.

Investment securities are exposed to market risk due to changes in interest rates and credit risk. We regularly

monitor credit risk and attempt to mitigate our exposure by investing in highly-rated securities and diversifying

our investment portfolio. As of December 31, 2011, the majority of our investment securities had credit ratings of

“AA–” or better from a major credit rating agency. Our investment securities are also actively managed with

respect to concentration. As of December 31, 2011, all investments with a single issuer and each individual

security was less than 10% of our investment securities portfolio.

Cash Flows from Operating Activities

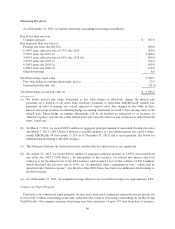

During the years ended December 31, 2011, 2010 and 2009, cash provided by operating activities was

$1,174.9 million, $994.4 million and $1,218.1 million, respectively. In the first quarter of 2010, we made a

$250.0 million tax deposit relating to United States federal tax liabilities, including those arising from our 2003

international restructuring, which have been previously accrued in our consolidated financial statements. Making

the deposit limits the further accrual of interest charges with respect to such tax liabilities, to the extent of the

deposit.

65