Western Union 2011 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2011 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Transaction fees and foreign exchange revenues

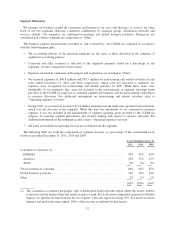

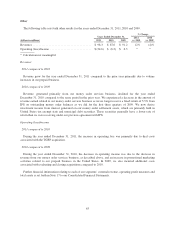

2011 compared to 2010

For the year ended December 31, 2011 compared to the same period in 2010, consumer-to-consumer money

transfer revenue grew 5%, on transaction growth of 6%. The weakening of the United States dollar compared to

most other foreign currencies positively impacted our revenue growth by approximately 1%, which was offset by

slight price reductions for the year ended December 31, 2011.

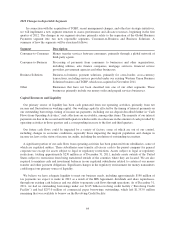

Revenue in our EMEASA region increased 4% during the year ended December 31, 2011 compared to the

same period in 2010 due to transaction growth of 4% as well as the other factors described above. The United

Kingdom, France, Germany, and the Gulf States continued to experience revenue and transaction growth for the

year ended December 31, 2011 versus the prior year, which was partially offset by softness in Southern Europe

and Russia and declines resulting from the political unrest in Libya and the Ivory Coast. Our money transfer

business to India experienced revenue growth of 11% and transaction growth of 10% for the year ended

December 31, 2011 versus the prior year.

Americas revenue increased 5% due to transaction growth of 6% for the year ended December 31, 2011

compared to the same period in 2010. Our domestic business experienced revenue growth of 8% for the year

ended December 31, 2011 due to transaction growth of 16%. Transaction growth in our domestic business was

higher than revenue growth due to transaction growth being greater in lower principal bands, which have lower

revenue per transaction. Our United States outbound business experienced both transaction and revenue growth

in the year ended December 31, 2011. Mexico revenue increased 2% on flat transactions for the year ended

December 31, 2011. Our Mexico business is being affected by on-going changes to our compliance procedures

related to the agreement and settlement with the State of Arizona and other states. These changes are expected to

cause our Mexico business to decline in 2012.

Revenue in our Asia Pacific (“APAC”) region increased 11% for the year ended December 31, 2011 compared

to the same period in 2010 due to transaction growth of 9% and the weakening of the United States dollar

compared to most other foreign currencies, which positively impacted revenue. China’s revenue increased 6% for

year ended December 31, 2011 on transaction growth of 4% for the year ended December 31, 2011.

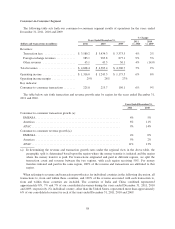

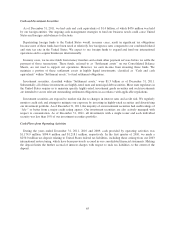

Foreign exchange revenues for the year ended December 31, 2011 grew compared to the same period in 2010,

driven primarily by increased amounts of cross-border principal sent.

Fluctuations in the exchange rate between the United States dollar and currencies other than the United States

dollar have resulted in a benefit to transaction fees and foreign exchange revenues for the year ended

December 31, 2011 of $39.1 million over the same period in 2010, net of foreign currency hedges, that would not

have occurred had there been constant currency rates. The largest benefit was related to the EMEASA region.

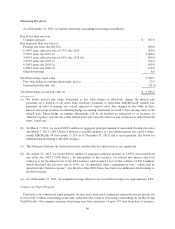

We have historically implemented and will likely implement future strategic fee reductions and actions to

adjust foreign exchange spreads, where appropriate, taking into account a variety of factors. Fee and foreign

exchange reductions generally reduce revenues in the near term, but are done in anticipation that they will result

in increased transaction volumes and increased revenues over time. In certain corridors, we may also implement

fee or foreign exchange spread increases. In 2011, we adjusted our reporting of the net impact of price

reductions. We now calculate the impact of price reductions against prior year transaction volumes, rather than

current year transaction volumes. We believe utilizing prior year transaction volumes more appropriately

differentiates between the impacts of price reductions versus other items impacting revenue. Under the new

methodology, the fee decreases and foreign exchange actions were approximately 1% of total Western Union

revenue for the full year 2011 compared to approximately 3% for the full year 2010, as fee reductions were

slightly lower and there is some offset by modest increases in foreign currency spreads in some corridors. Under

the previous methodology, we reported that the impact of price reductions in 2010 was 4%.

59