Western Union 2011 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2011 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

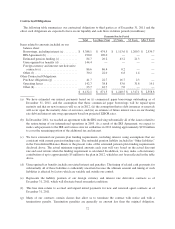

Other

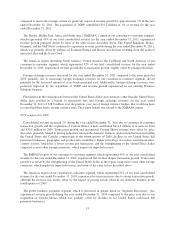

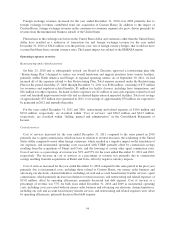

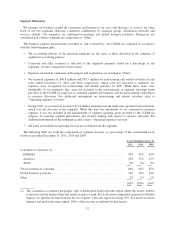

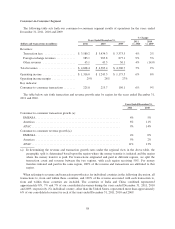

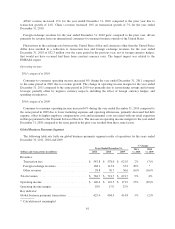

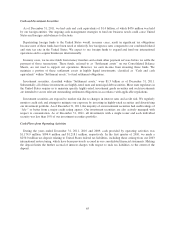

The following table sets forth other results for the years ended December 31, 2011, 2010 and 2009.

Years Ended December 31,

% Change

2011

vs. 2010

2010

vs. 2009(dollars in millions) 2011 2010 2009

Revenues ........................................ $ 98.3 $ 87.6 $ 91.2 12% (4)%

Operating (loss)/income ............................ $(24.6) $ (6.2) $ 6.3 * *

* Calculation not meaningful

Revenues

2011 compared to 2010

Revenue grew for the year ended December 31, 2011 compared to the prior year primarily due to volume

increases in our prepaid business.

2010 compared to 2009

Revenue, generated primarily from our money order services business, declined for the year ended

December 31, 2010 compared to the same period in the prior year. We experienced a decrease in the amount of

revenue earned related to our money order services business as we no longer receive a fixed return of 5.5% from

IPS on outstanding money order balances as we did for the first three quarters of 2009. We now derive

investment income from interest generated on our money order settlement assets, which are primarily held in

United States tax exempt state and municipal debt securities. These securities generally have a lower rate of

return than we were receiving under our previous agreement with IPS.

Operating (loss)/income

2011 compared to 2010

During the year ended December 31, 2011, the increase in operating loss was primarily due to deal costs

associated with the TGBP acquisition.

2010 compared to 2009

During the year ended December 31, 2010, the decrease in operating income was due to the decrease in

revenue from our money order services business, as described above, and an increase in promotional marketing

activities related to our prepaid business in the United States. In 2009, we also incurred additional costs

associated with evaluating and closing acquisitions compared to 2010.

Further financial information relating to each of our segments’ external revenue, operating profit measures and

total assets is set forth in Note 17 to our Consolidated Financial Statements.

63