Western Union 2011 Annual Report Download - page 140

Download and view the complete annual report

Please find page 140 of the 2011 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE WESTERN UNION COMPANY

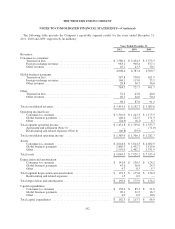

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

contracts of $21.6 million, which increased the effective rate to 4.4%, in “Accumulated other

comprehensive loss,” which will be amortized into “Interest expense” over the life of the 2018 Notes. See

below for additional detail relating to the debt issuance.

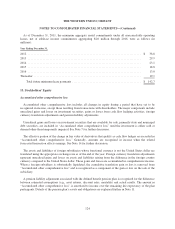

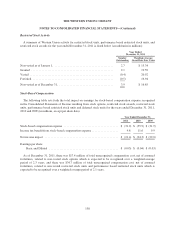

(f) As of December 31, 2011, the Company’s weighted-average effective rate on total borrowings was

approximately 4.8%.

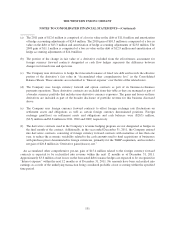

The aggregate fair value of the Company’s borrowings, based on quotes from multiple banks, excluding the

impact of related interest rate swaps, was $3,563.5 million and $3,473.6 million as of December 31, 2011 and

2010, respectively.

The Company’s maturities of borrowings at par value as of December 31, 2011 are $300.0 million in 2012,

$300.0 million in 2013, $500.0 million in 2014, $1.0 billion in 2016 and approximately $1.5 billion thereafter.

The Company’s obligations with respect to its outstanding borrowings, as described below, rank equally.

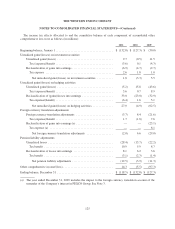

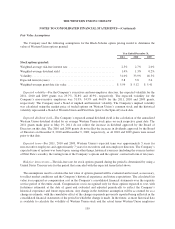

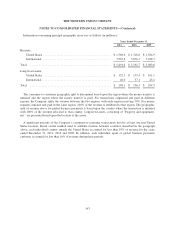

Commercial Paper Program

Pursuant to the Company’s commercial paper program, the Company may issue unsecured commercial paper

notes in an amount not to exceed $1.5 billion outstanding at any time, reduced to the extent of borrowings

outstanding on the Company’s Revolving Credit Facility. The Commercial Paper Notes may have maturities of

up to 397 days from date of issuance. The Company’s commercial paper borrowings as of December 31, 2011

had a weighted-average annual interest rate of approximately 0.6% and a weighted-average term of 9 days.

During the year ended December 31, 2011, the average commercial paper balance outstanding was $89.7 million

and the maximum balance outstanding was $784.1 million. Proceeds from the Company’s commercial paper

borrowings were used for general liquidity. The Company had $297.0 million of commercial paper outstanding

as of December 31, 2011 and no commercial paper borrowings outstanding as of December 31, 2010.

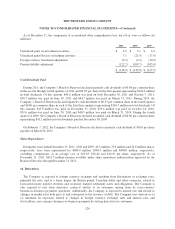

Revolving Credit Facility

On September 23, 2011, the Company entered into a credit agreement which expires January 2017 providing

for unsecured financing facilities in an aggregate amount of $1.65 billion, including a $250.0 million letter of

credit sub-facility and a $150.0 million swing line sub-facility (“Revolving Credit Facility”). The Revolving

Credit Facility replaced the Company’s $1.5 billion revolving credit facility that was set to expire in September

2012. Consistent with the prior facility, the Revolving Credit Facility contains certain covenants that, among

other things, limit or restrict the Company’s ability to sell or transfer assets or merge or consolidate with another

company, grant certain types of security interests, incur certain types of liens, impose restrictions on subsidiary

dividends, enter into sale and leaseback transactions, or incur certain subsidiary level indebtedness, subject to

certain exceptions. Also consistent with the prior facility, the Company is required to maintain compliance with a

consolidated interest coverage ratio covenant. The Revolving Credit Facility supports borrowings under the

Company’s $1.5 billion commercial paper program.

Interest due under the Revolving Credit Facility is fixed for the term of each borrowing and is payable

according to the terms of that borrowing. Generally, interest is calculated using a selected LIBOR rate plus an

interest rate margin of 90 basis points. A facility fee of 10 basis points is also payable quarterly on the total

facility, regardless of usage. Both the interest rate margin and facility fee percentage are based on certain of the

Company’s credit ratings.

133