United Airlines 2015 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2015 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

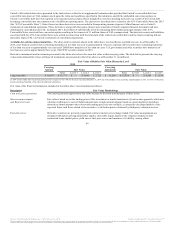

The obligations of UAL, United and Mileage Plus Holdings, LLC to Chase under the Co-Brand Agreement are joint and several. Certain of United’s

obligations under the Co-Brand Agreement are secured by a junior lien in all collateral pledged by United under the Credit Agreement. United also provides

a first priority lien to Chase on its MileagePlus assets to secure certain of its obligations under the Co-Brand Agreement and its obligations under the credit

card processing agreement among United, Paymentech, LLC and JPMorgan Chase Bank, N.A.

United leases aircraft, airport passenger terminal space, aircraft hangars and related maintenance facilities, cargo terminals, other airport facilities, other

commercial real estate, office and computer equipment and vehicles.

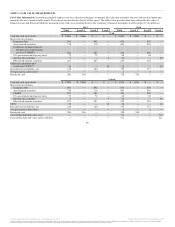

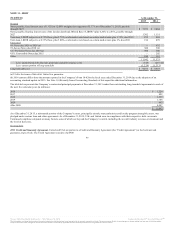

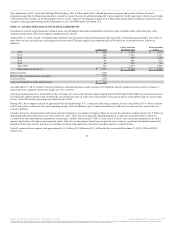

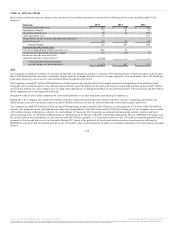

At December 31, 2015, United’s scheduled future minimum lease payments under operating leases having initial or remaining noncancelable lease terms of

more than one year, aircraft leases, including aircraft rent under CPAs and capital leases (substantially all of which are for aircraft) were as follows (in

millions):

2016 $ 206 $ 1,252 $ 1,317

2017 162 1,161 1,317

2018 151 899 1,100

2019 86 809 918

2020 66 920 708

After 2020 747 6,799 2,660

Minimum lease payments $ 1,418 $ 11,840 $ 8,020

Imputed interest (556)

Present value of minimum lease payments 862

Current portion (135)

Long-term obligations under capital leases $ 727

As of December 31, 2015, United’s aircraft capital lease minimum payments relate to leases of 47 mainline and 29 regional aircraft as well as to leases of

nonaircraft assets. Imputed interest rate ranges are 3.5% to 20.8%.

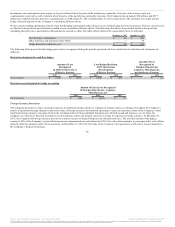

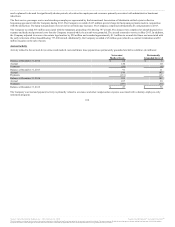

Aircraft operating leases have initial terms of five to twenty-six years, with expiration dates ranging from 2016 through 2024. Under the terms of most leases,

United has the right to purchase the aircraft at the end of the lease term, in some cases at fair market value, and in others, at fair market value or a percentage

of cost. United has facility operating leases that extend to 2041.

During 2015, the Company reached an agreement with AerCap Holdings N.V., a major aircraft leasing company, to lease used Airbus A319s. Eleven aircraft

will be delivered over the next two years beginning in early 2016. In addition, up to 14 more aircraft may be delivered over the next five years subject to

certain conditions.

United is the lessee of real property under long-term operating leases at a number of airports where we are also the guarantor of approximately $1.5 billion of

underlying debt and interest thereon as of December 31, 2015. These leases are typically with municipalities or other governmental entities, which are

excluded from the consolidation requirements concerning a variable interest entity (“VIE”). To the extent United’s leases and related guarantees are with a

separate legal entity other than a governmental entity, United is not the primary beneficiary because the lease terms are consistent with market terms at the

inception of the lease and the lease does not include a residual value guarantee, fixed-price purchase option, or similar feature.

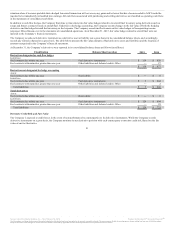

United’s nonaircraft rent expense was approximately $1.3 billion, $1.4 billion and $1.3 billion for the years ended December 31, 2015, 2014 and 2013,

respectively.

98

Source: United Continental Holdings, Inc., 10-K, February 18, 2016 Powered by Morningstar® Document Research℠

The information contained herein may not be copied, adapted or distributed and is not warranted to be accurate, complete or timely. The user assumes all risks for any damages or losses arising from any use of this information,

except to the extent such damages or losses cannot be limited or excluded by applicable law. Past financial performance is no guarantee of future results.