United Airlines 2015 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2015 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

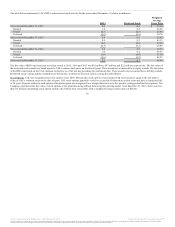

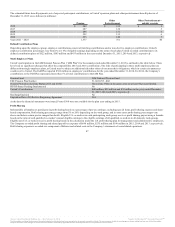

settlements with taxing authorities, unrecognized tax benefits as a result of tax positions taken during a prior period and unrecognized tax benefits relating

from a lapse of the statute of limitations were immaterial during 2015, 2014 and 2013. The Company does not expect significant increases or decreases in

their unrecognized tax benefits within the next 12 months.

There are no significant amounts included in the balance at December 31, 2015 for tax positions for which the ultimate deductibility is highly certain but for

which there is uncertainty about the timing of such deductibility.

The Company’s federal income tax returns for tax years after 2002 remain subject to examination by the Internal Revenue Service (“IRS”) and state taxing

jurisdictions. Currently, there are no ongoing examinations of the Company’s prior year tax returns being conducted by the IRS.

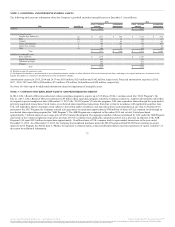

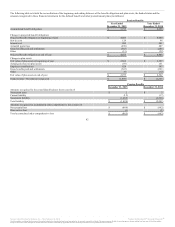

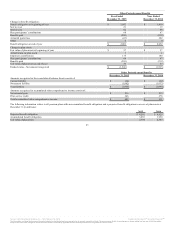

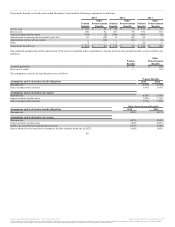

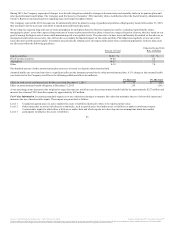

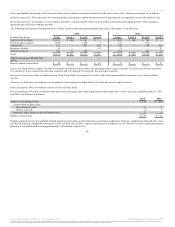

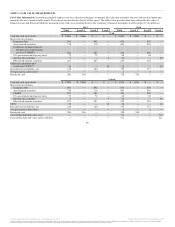

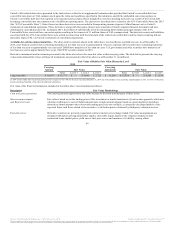

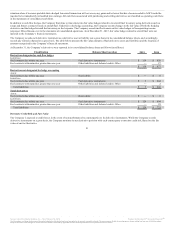

The following summarizes the significant pension and other postretirement plans of United:

Pension Plans

United maintains two primary defined benefit pension plans, one covering certain pilot employees and another covering certain U.S. non-pilot employees.

Each of these plans provide benefits based on a combination of years of benefit accruals service and an employee’s final average compensation. Additional

benefit accruals were frozen under the plan covering certain pilot employees during 2005 and management and administrative employees as of December 31,

2013 at which time any existing accrued benefits for those employees were preserved. Benefit accruals for certain non-pilot employees under its other

primary defined benefit pension plan continue. United maintains additional defined benefit pension plans, which cover certain international employees.

Other Postretirement Plans

We maintain postretirement medical programs which provide medical benefits to certain retirees and eligible dependents, as well as life insurance benefits to

certain retirees participating in the plan. Benefits provided are subject to applicable contributions, co-payments, deductibles and other limits as described in

the specific plan documentation.

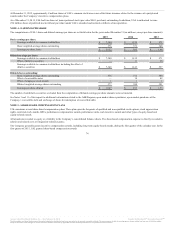

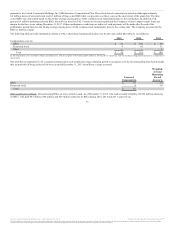

Changes in benefits that either qualified as curtailments (which reduced prior actuarial losses) or negative plan amendments are detailed in the tables below.

Actuarial assumption changes are reflected as a component of the net actuarial gains/(losses) during 2015 and 2014. These amounts will be amortized over

the average remaining service life of the covered active employees or the average life expectancy of inactive participants and will impact 2015 and 2014

pension and retiree medical expense as described below.

81

Source: United Continental Holdings, Inc., 10-K, February 18, 2016 Powered by Morningstar® Document Research℠

The information contained herein may not be copied, adapted or distributed and is not warranted to be accurate, complete or timely. The user assumes all risks for any damages or losses arising from any use of this information,

except to the extent such damages or losses cannot be limited or excluded by applicable law. Past financial performance is no guarantee of future results.